Apple CEO Tim Cook issued a letter late Wednesday to investors advising that a slowdown in China sales would cause fourth quarter revenue to decline 4.8% year over year to $84 billion, well below analyst estimates. It's not that Apple is losing money - far from that - it's just not making as much as expected. Shares of Apple (AAPL) were down nearly 10% on the news, the largest one-day loss in six years.

Combined with a report from the Institute for Supply Management (ISM) that had December's PMI fall by the most since the financial crisis of 2008, stocks were on the defensive all day long. The report concluded that December PMI fell from 59.3 to 54.1, a descent of 5.4%. While anything over 50 is considered expansion, the falloff is considered to be a harbinger of worse data to come, as many participants in the survey blamed trade tensions with China as a leading cause for the slowdown.

Thus, the 1000+ point gain from December 26 was cut down by two-thirds on Thursday, just a week later, sending the Dow and other major indices closer to bear market territory once again.

January has gotten off to a horrible start, as though December's rout hadn't ended, which, of course, would be correct. Losses on stocks are only just beginning. By March of this year, expect stocks to be another 10-15% lower than where they stand today, and, even then, with signs of a global slowdown flashing red, a bottom won't likely be put in until the market has flushed out all of the weak hands and sent fund managers scurrying in even greater numbers to cash and bonds.

Presently, the treasuries are telling an interesting story about the economy. While the Federal Reserve insisted on raising rates four times in 2019, the bond market has expressed extreme displeasure, sending the yield on the 10-year note to 2.56%, down ten basis points just today, marking the lowest yield since January of last year. Additionally, short-maturity bills spiked (thanks to Fed hikes at the low end) with the one-year yielding 2.50%, as compared to 2.39% for the 2-year and 2.37% for the five-year note. Inversion in accelerating at the short end of the curve.

While this is traditionally not the pairs that signal recession, that distinction belonging to the 2s-10s spread, it is highly unusual. Bond traders are saying they don't want to issue longer-term, for fear that the economy will weaken as time progresses. The 30-year also was slammed lower, yielding 2.92%, down five basis points from yesterday.

2019 is looking to be an even worse year for equity investors, and a rout in the stock market could cause panic to spread to many diverse levels of economic activity. A recession within the next three to twelve months is looking more a certainty with each passing day.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

At the Close, Thursday, January 3, 2019:

Dow Jones Industrial Average: 22,686.22, -660.02 (-2.83%)

NASDAQ: 6,463.50, -202.43 (-3.04%)

S&P 500: 2,447.89, -62.14 (-2.48%)

NYSE Composite: 11,190.44, -193.09 (-1.70%)

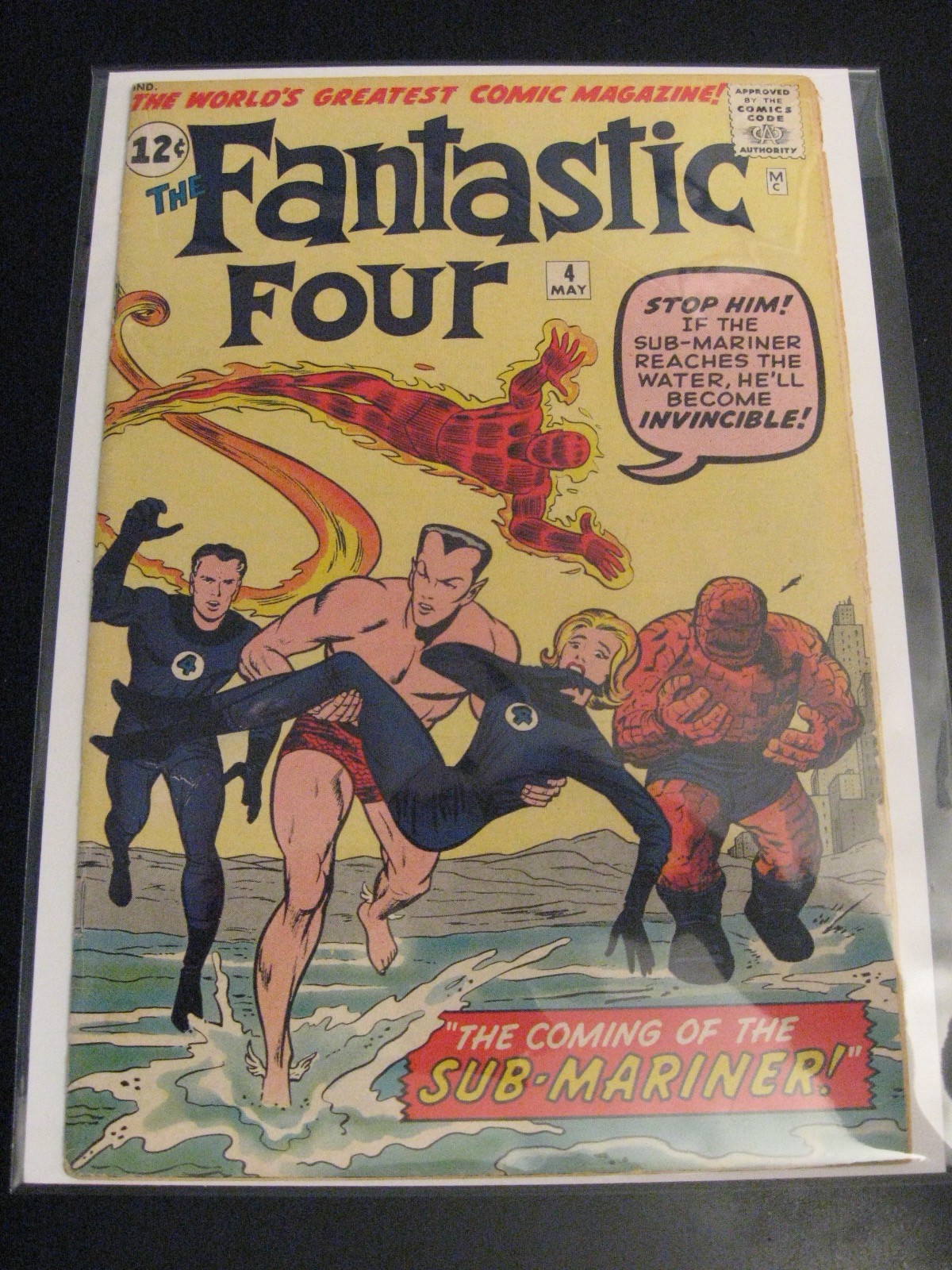

What's more impressive than chasing stocks are the devotees of Marvel comics, especially the 12-cent variety from the early 60s. If you're in your 60s or older, you may remember this one from your youth. If you gave it away or trashed it, as many of us did, you might be sick to see what it's worth today.

What's more impressive than chasing stocks are the devotees of Marvel comics, especially the 12-cent variety from the early 60s. If you're in your 60s or older, you may remember this one from your youth. If you gave it away or trashed it, as many of us did, you might be sick to see what it's worth today.