|

| Steve Carell and Ryan Gosling in scene from "The Big Short" |

That's the truth of the matter, usually every day, so long as the Federal Reserve continues to pump fresh capital into the already bloated financial system. The trouble with the Fed's desire to keep Wall Street flush with cash is that enriching a small number of already-wealthy people hasn't had the desired effect of "trickling down" to the general population.

It didn't work when the Fed rescued the financial system in 2007-09, hasn't since, and won't in the future. Known generally as QE (Quantitative Easing) it's a failed policy that produces nothing other than overpriced financial assets, monstrous bubbles, and eventually, mass damage to the very system it's purported to be protecting. Since September of last year (2019) the Fed has already pumped nearly a trillion dollars into the Wall Street casino and it's balance sheet has exploded by another $500 billion.

To say that the Fed's promotion of QE is as bad as the systemic fraud that ran rampant within the sub-prime mortgage bundling that triggered the GFC in 2007-09 might be taking the comparison a step too far, but it surely is worth nominal consideration.

The players are mostly the same: Wall Street tycoons representing trading firms of the biggest banks bent on maximizing profits, relaxed, corrupted, and often incompetent regulators, an unsuspecting public that eventually gets fleeced.

In comparison to the sub-prime hustle, the rollers and managers of the mortgage bundling are now - as before - manned by the trading desks of the big Wall Street firms. The Fed is the enabler, a la the ratings agencies during sub-prime, and mouth-breathing borrowers with low credit scores seeking to purchase a home are replaced today by anybody participating in a pension fund, college fund, 401k or other managed investment vehicle. That's why sub-prime was called the housing bubble and the ongoing, current arrangement is called the "everything bubble." Everything is up for grabs and everything is at stake.

This all has been tied together neatly since the GFC, as, after $750 billion in TARP was exhausted, three bouts of QE commenced, secret loans from the Fed to foreign banks were proffered, and nobody of any importance went to jail over the excesses of the sub-prime boom and subsequent bust. Nobody. They're mostly all still there, having cashed mammoth bonus checks provided by the TARP bailout, plotting the next windfall.

|

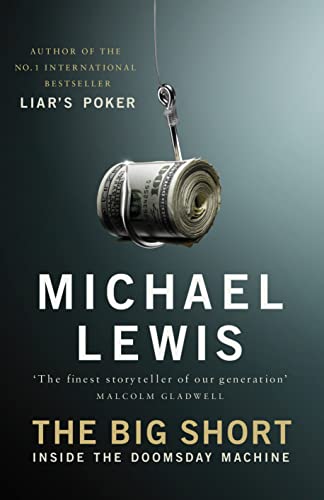

| Lewis' book is revealing and riveting, available everywhere, for a song. |

In the film, Ryan Gosling plays Jared Vennett, the fictional character based on the real-life Deutsche Bank trader, Greg Lippman. Christian Bale plays the real-life Michael Burry, the Scion Asset Management leader who risked his firm and cashed in when MBS and CDOs went bust, but the lion of the story comes n the character of Mark Baum (Steve Eisman in real life) played passionately by Steve Carell as the angry, perplexed head of Frontline Partners, the independent Morgan Stanley trading unit that bet against CDOs and made millions in the sub-prime collapse.

Carell, as Mark Baum, sets up the character and the film's premise in his first scene, railing against big banks charging outrageous fees for overdrafts. His defiant, conflicted, crusading manner defined, Carell storms through the film wide-eyed and aghast at what's about to happen to the global financial structure, outspoken and often outrageous. Nearing the end, he - and the character of Ben Rickert (based on real life, former JP Morgan trader, Ben Hockett, and portrayed in a sublimated, almost solemn manner by Brad Pitt) - realizes that he is betting on the collapse of the bedrock of global finance, the US housing industry, and trillions of dollars will be lost, millions of people will lose homes. The fate of the world weighs heavy upon him.

The Big Short film is well worth watching again, as is a thorough reading of the original Michael Lewis book by the same name. In case you haven't seen the movie or read the book, this qualifies as a MUST, if you have money at risk in any kind of investment because it all is happening again, in a different venue, on an even larger, more obscene scale. Sub-prime took years to grow, metastasize and engulf the financial system. The ongoing "everything bubble," with pension and other long-term passive investments as the target, will literally take decades, and it's already well underway.

It's all happening again in a bigger and more destructive way and it's happening right NOW.

The book and film are available at screaming low prices on Ebay, Amazon and various streaming services (for the film). A purchase is likely to be some of the best investment money ever spent and an understanding of the process will reveal the fraud and deceit being parlayed right beneath the public's noses. Both the book and the film are revealing, frightening, and true.

EDIT: Money Daily may not always be on top of the news, but today's major blast posting may turn out to be prescient. Just moments ago, Wall Street On Parade, the noteworthy blog published by Wall Street insiders, Russ and Pam Martens, released a related post: The Doomsday Machine Returns: Citibank Has Sold Protection On $858 Billion of Credit Default Swaps. In the article, the writers contend that the dark doom of 2008 may be hanging over the canyons of Wall Street once again, as not just Citibank, but JP Morgan Chase as well, have taken big positions in Credit Default Swaps "that are being used to reignite the synthetic Collateralized Loan Obligation (synthetic CDO) market - which vastly added to the leverage that blew up Wall Street in 2008."

Stay tuned.

A few choice clips from the film:

At the Close, Thursday, January 2, 2020:

Dow Jones Industrial Average: 28,868.80, +330.36 (+1.16%)

NASDAQ: 9,092.19, +119.58 (+1.33%)

S&P 500: 3,257.85, +27.07 (+0.84%)

NYSE Composite: 14,002.49, +89.46 (+0.64%)

No comments:

Post a Comment