Following four years of absolute chaos and disgrace on the world stage, a large segment of the American public thought they were voting for change and salvation in electing Donald J. Trump as the 47th president of the country, and, in the beginning of his term, starting with DOGE and expulsion of illegal immigrants, it appeared that possibly, America could get back on a positive track.

Following four years of absolute chaos and disgrace on the world stage, a large segment of the American public thought they were voting for change and salvation in electing Donald J. Trump as the 47th president of the country, and, in the beginning of his term, starting with DOGE and expulsion of illegal immigrants, it appeared that possibly, America could get back on a positive track.

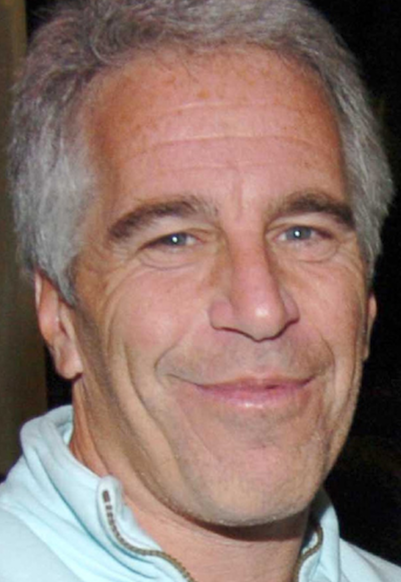

Since the fateful "liberation day" fiasco upon which President Trump announced punishing tariffs on countries around the world, sending the stock market reeling into bear market territory, many Americans who supported and voted for the president have been abandoning him in large numbers, but Monday's announcement by the Department of Justice, in collaboration with the FBI, that the Jeffrey Epstein investigation was closed with no evidence of a large-scale blackmailing operation or a client list, and, concluding that Epstein committed suicide, appears to have been the last straw.

Because of the unsigned statement issued by the DoJ, and the embarrassing follow-up denial by Trump and Attorney General Pam Bondi featured in the clip below, supporters of the president and the MAGA movement are abandoning this administration in droves.

Notably, the question, Trump's quizzical response, and, especially, Pam Bondi's detailed, unprompted response concerning her prior statements, the missing minute from the prison tapes, and the allegation of "child porn downloaded by that disgusting Jeffrey Epstein" appear to have been completely pre-rehearsed and scripted.

Furor over the failed - and likely covered-up - investigation into Epstein's affairs is growing and likely to tear the country further apart, though further downside for the government comes in the form of former MAGA loyalists now siding with far-left Trump-haters who have derided the administration's policies from day one.

Tech billionaire Elon Musk, the former Trump adviser, posted Tuesday on his X platform, “How can people be expected to have faith in Trump if he won’t release the Epstein files?”

Burying of the Epstein files and video tapes, which likely implicate many members of congress, former president Bill Clinton and possibly President Trump himself, along with other high-ranking politicians, judges, Hollywood movie stars, producers, and tech billionaires (Bill Gates), are almost certain to prove the undoing of Trump, his administration, the whole of government, and the social contract with the American people.

It is the touchstone - the black swan - which could trigger mayhem and violence, some almost certain to be the product of deep state operatives and false flags. Shading of the truth, denial to come clean with the American public on matters of extreme importance - many of which the president campaigned on - will prove to be the undoing of the American experience, sadly, on the cusp of the country's 250th anniversary. America will be lucky to avoid civil war.

The Epstein matter isn't the only fumble by the administration. After month's of tireless work by Elon Musk and his DOGE team to uncover waste, fraud, and abuse in government, nearly none of it was codified by congress in their "big, beautiful bill", the continuing resolution passed recently and signed by Trump on July 4. The bill itself is chock full of pork, over-spending, higher deficits, and perks for billionaires and congress, when the president and members of congress - mostly Republicans - had promised to reduce government and begin a process to balance the budget. Really can’t blame all Democrats for voting against it, albeit for all the wrong reasons. Both parties - now essentially a uniparty - are equally corrupt and complicit in crimes against the American people and humanity in general.

While Trump has effectively closed the U.S. southern border, deportations have been slow to materialize. It's largely being suggested by political junkies on the left and the right, that most of the estimated 30-40 million illegals still residing in the United States will be offered amnesty and a path to citizenship rather than rightfully being sent back to their countries of origin.

Other failures by President Trump include not halting arms and financial aid to Ukraine, which would have ended the war immediately as he promised during the campaign. Further support for Israel in its genocide in Gaza and endless warring against Iran and most of the Arab world is a sore point for almost everybody, from leftists to pacifists, to former right-wing supporters.

Trump's tariff back-and-forth posturing is cause for alarm. His recent post on Truth Social of imposing an additional 10 percent tariff on BRICS nations or those aligned with their (in Trump's words) "anti-American" policies, was a backhand to countries representing more than 60% of world commerce. Rather than any attempt at conciliation with the rest of the world, Trump, congress, and their supporters are continuing with sanctions, tariffs, and other forms of punishment that will only serve to alienate the United States further.

President Trump has made no mention of giving back the money stolen from Russia at the onset of the Ukraine conflict in 2022. There is still roughly $300 to $400 billion in Russian assets frozen by the U.S., UK, and EU, that should rightfully be returned.

There's no investigation into the affairs of the Bidens, nor into any of the countless numbers of congresspeople and senators who made trips to Ukraine and received $$$ millions in kickbacks and bribes. There's been no audit of how the money and arms sent to Ukraine were dispersed. The list of failures, mostly of doing nothing in the face of obvious corruption at the highest levels of government and business, grows longer and longer with each passing day.

As far as Wall Street is concerned, the party rages on no matter the circumstance. When Wall Street bankers plead for a poor employment report so that the Federal Reserve will have reason to cut interest rates and the BLS non-farm payroll is revealed as positive, that serves as cause for celebration and a continuance of the rally.

It doesn't take a stock market genius to observe patterns of fraud in stocks and manipulation of the bond markets. How many times do the S&P and NASDAQ have to finish close to unchanged before people realize the depth of corruption and rigging in U.S. markets by the rich and powerful? Vanguard and BlackRock own most of the shares of stock in the most important companies. They can move markets in whichever way they please.

The rest of the world looks upon the United States with a growing sense of tragedy. Europe, for what it's worth, is already finished, their formerly homogenous populations now polluted with migrants from the Middle East, Africa, Asia, and other foreign locales, the immigrants given free reign over the native populations in countries ranging from Sweden, to France, to Germany, Spain, and beyond. Great Britain is no longer great, or even British. They're completely finished as a country and a government.

When people lose faith in institutions of the government, the ability to govern is severely impaired, eventually to a point at which the general population becomes ungovernable. Given rates of inflation, the continued debasement of the nearly-worthless U.S. dollar, now amplified by backward-thinking trade policies that will only exacerbate the situation, the average consumer is squeezed, not only by higher prices, but higher taxes at the state and local levels, more extreme government regulations and denial of basic rights of free speech, assembly, and importantly, a free, critical press. America is very far a breaking point.

From all indications, America is circling the drain of failed empires like many before it. The country is no longer capable of projecting military power. China and Russia have exceeded the U.S. capacity both in terms of quantity and quality. U.S. posturing as a military force with which to be reckoned is at best a bluffing tactic. Rather than seek peace - as Trump promised - the decades old practice of bombing opponents into submission is now the preferred tactic.

Standards of living in the United States continue to decline. The wealth gap continues to grow. Arrogance and hubris by the federal government is unceasing. All of these things, and more, point in only one direction.

249 years. It was a good run, America. But now, it's over.

Henceforth, Money Daily will strive to focus on the economies of the rest of the world, especially BRICS and the Global South, where cooperation and inclusion are fostered and economies are growing as they move away from dollar hegemony. The U.S. and its Western allies are failed states, grasping at economic and political straws like drowning people. Asia, Africa, South America and the Middle East are bustling with activity, growth, cooperation, and prosperity.

Regards,

Fearless Rick

At the Close, Tuesday, July 8, 2025:

Dow: 44,240.76, -165.60 (-0.37%)

NASDAQ: 20,418.46, +5.9 (+0.03%)

S&P 500: 6,225.52, -4.46 (-0.07%)

NYSE Composite: 20,541.96, -3.64 (-0.02%)