Over the course of the Martin Luther King Jr. holiday weekend, I burned out.

I no longer had any interest in penning my "Weekend Wrap," as it has come to be known. The stock market was no longer of any interest to me. I didn't write my usual column, and, I didn't write my daily market commentary on Tuesday either.

It's not as if this was a sudden, knee-jerk reaction to anything. This has been brewing inside me for a long time. Obviously, I don't even care anymore to write in the third person, as has been the usual mode of this blog. It's just not important, just as money and markets aren't important, to me, at least.

Maybe money is important to you. Maybe the ups and downs of Wall Street matter to you, to your feelings of well being, to your existence. Money and markets are not existential prerogatives to me. Never have been. And now, they really don't matter at all.

I took an interest in stocks, bonds, money, and business when I was very young. At the age of six, I was intrigued by the small type in the newspaper displaying the gains and losses of big companies. To me, at such a tender age, the world of business and finance was a fantastic place populated by titans of industry, upstanding men of character and wisdom who employed their thinking and inventiveness to build fabulous engines of wealth. Such a fascination with money and business served me well along my path through adolescence and into adulthood. I conceived any number of business ideas, launched most, failed at many, until finally, by age 30, I found success in the newspaper business.

Perhaps the rude awakening to how business actually operated was where my burnout began and it just took a long time for me to realize it. I don't like the way business is conducted anymore. When I was in business - in the 80s, before the internet - an office, a phone, and a car were just about all one needed to get oneself on the path to riches. Almost all of the deals and ad sales I did were in person. A few were done by phone, but a follow-up personal visit was always required. I did business with people, in person. Try that today and you'll be laughed out of most places. It's an email, a text, a slick website and an electronic funds transfer. Done.

Wall Street, for all it's glamor and glory, is different now as well. A quarter point or half point gain - which used to be a big deal - is now 0.25 or 0.50, and it's nothing. Hedge funds, fake news, the Federal Reserve, and a host of unseen forces - algorithms, HFTs, ETFs, the PPT - have destroyed whatever was left of free markets and the "old Wall Street after the ravages of 9/11/2001. There's no Louis Rukeyser's "Wall Street Week" on Friday nights. Today it's CNBC, wall-to-wall, all the time, blaring the trumpets for the honorable necessity of owning stocks all day long, all night long.

It's boring, and most of the time, it's meaningless, or downright wrong. Stocks all move in tandem today. There's no science; only emotion, and mine is spent.

My personal short literary demise - which this is - may have more to do with anxiety over the fate of our nation than my dislike for the current rigors of finance. Everything is in chaos and there doesn't seem to be any end to it. Nor is there any sense to it, anymore. Tucker Carlson's tirade from a few weeks back encapsulates much of what I'm feeling, but, for me, there's more.

There has to be more than stocks. When I figure out what that is, I'll be back.

Wednesday, January 23, 2019

Thursday, January 17, 2019

Fake News Bumps Stocks Higher (No Kidding!)

A Wall Street Journal story that Treasury Secretary Steven Mnuchin discussed lifting some or all tariffs imposed on Chinese imports and suggested offering a tariff rollback - later dismissed as false - sent stocks soaring on outrageous volume at 2:37 pm ET.

Any questions?

At the Close, Thursday, January 17, 2019:

Dow Jones Industrial Average: 24,370.10, +162.94 (+0.67%)

NASDAQ: 7,084.46, +49.77 (+0.71%)

S&P 500: 2,635.96, +19.86 (+0.76%)

NYSE Composite: 11,994.54, +86.93 (+0.73%)

Dow Jones Industrial Average January Scorecard:

Any questions?

At the Close, Thursday, January 17, 2019:

Dow Jones Industrial Average: 24,370.10, +162.94 (+0.67%)

NASDAQ: 7,084.46, +49.77 (+0.71%)

S&P 500: 2,635.96, +19.86 (+0.76%)

NYSE Composite: 11,994.54, +86.93 (+0.73%)

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

| 1/9/19 | 23,879.12 | +91.67 | +551.66 |

| 1/10/19 | 24,001.92 | +122.80 | +674.46 |

| 1/11/19 | 23,995.95 | -5.97 | +669.49 |

| 1/14/19 | 23,909.84 | -86.11 | +583.38 |

| 1/15/19 | 24,065.59 | +155.75 | +739.13 |

| 1/16/19 | 24,207.16 | +141.57 | +880.70 |

| 1/17/19 | 24,370.10 | +162.94 | +1043.64 |

Wednesday, January 16, 2019

Bank Stocks Boost Market; Vanguard's John Bogle Dead At 89

On the backs of earnings from Bank of American (BAC) and Goldman Sachs (GS), stocks took another step forward as January 2019 is beginning to look a lot like January 2018.

The Dow has already added 880 points in the new year, the NASDAQ, 400, the S&P 500, 110. Of the 11 trading sessions so far in 2019, the major indices have finished in positive territory in eight of them.

On the day, point gains were minimized in late selling, suggesting that the bank earnings were not out of the ordinary nor any indication that the economy was picking up speed, only that money needs to be parked somewhere, there's plenty of it sloshing around and BAC and GS had been beaten down recently.

In some sad news, John C. Bogle, the founder of the Vanguard Group and the inventor of the index fund, has died at age 89. Bogle was one of the great financial minds of our time and a very decent human being. His wisdom and wit will be missed.

Dow Jones Industrial Average January Scorecard:

At the Close, Wednesday, January 16, 2019:

Dow Jones Industrial Average: 24,207.16, +141.57 (+0.59%)

NASDAQ: 7,034.69, +10.86 (+0.15%)

S&P 500: 2,616.10, +5.80 (+0.22%)

NYSE Composite: 11,907.61, +38.93 (+0.33%)

Joke of the Day: NY junior Senator Kirsten Gillibrand announces Presidential bid. This woman barely qualifies as a Senator, elected to the seat vacated by Hillary Clinton, she was only viable as a shoe-in in one of the most liberal states in the country. Her list of accomplishments includes the shaming of Al Franken.

Gillibrand, in addition to praising voters last year that she would not run for president and would serve out her full term in the senate if re-elected (probably true, that), has often changed her views. When she was a member the House of Representatives in 2008, she received an "A" rating from the NRA for her positions on gun control. In 2018, the NRA gave her an "F."

The Dow has already added 880 points in the new year, the NASDAQ, 400, the S&P 500, 110. Of the 11 trading sessions so far in 2019, the major indices have finished in positive territory in eight of them.

On the day, point gains were minimized in late selling, suggesting that the bank earnings were not out of the ordinary nor any indication that the economy was picking up speed, only that money needs to be parked somewhere, there's plenty of it sloshing around and BAC and GS had been beaten down recently.

In some sad news, John C. Bogle, the founder of the Vanguard Group and the inventor of the index fund, has died at age 89. Bogle was one of the great financial minds of our time and a very decent human being. His wisdom and wit will be missed.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

| 1/9/19 | 23,879.12 | +91.67 | +551.66 |

| 1/10/19 | 24,001.92 | +122.80 | +674.46 |

| 1/11/19 | 23,995.95 | -5.97 | +669.49 |

| 1/14/19 | 23,909.84 | -86.11 | +583.38 |

| 1/15/19 | 24,065.59 | +155.75 | +739.13 |

| 1/16/19 | 24,207.16 | +141.57 | +880.70 |

At the Close, Wednesday, January 16, 2019:

Dow Jones Industrial Average: 24,207.16, +141.57 (+0.59%)

NASDAQ: 7,034.69, +10.86 (+0.15%)

S&P 500: 2,616.10, +5.80 (+0.22%)

NYSE Composite: 11,907.61, +38.93 (+0.33%)

Joke of the Day: NY junior Senator Kirsten Gillibrand announces Presidential bid. This woman barely qualifies as a Senator, elected to the seat vacated by Hillary Clinton, she was only viable as a shoe-in in one of the most liberal states in the country. Her list of accomplishments includes the shaming of Al Franken.

Gillibrand, in addition to praising voters last year that she would not run for president and would serve out her full term in the senate if re-elected (probably true, that), has often changed her views. When she was a member the House of Representatives in 2008, she received an "A" rating from the NRA for her positions on gun control. In 2018, the NRA gave her an "F."

Labels:

BAC,

Bank of America,

GS. Goldman Sachs,

index fund,

Jack Bogle,

John C. Bogle,

Vanguard

Tuesday, January 15, 2019

Stocks Rise Despite Spate Of Bad News, Brexit No-Go Vote

Some are wondering whether the market is being run by computers or human operatives, or, worse yet, humans running computers front-running the market.

What may be happening is that humans are programming computer algorithms to react to fake news and the PPT is backstopping each and every tick lower by buying futures, resulting in the altos readjusting to buy more.

There was a good deal of bad news flow in the morning... and then just after 7:00 pm London time (2:00 pm ET), there was the Brexit vote.

Here's what passed across the wires prior to the opening bell and shortly thereafter:

With all this in the cooker, stocks opened higher and took off from there. The Dow exploded to a gain of 190 points just before noon. The NASDAQ was up nearly 120 points.

After noon, the markets went into a wait-and-see mood as the Brexit vote approached. In what has to be the most convoluted, time-wasting exercise in government over-reach (possibly challenged by the partial shutdown in the US), Britain has been wrangling over just how to depart from the European Union after a referendum passed nearly two-and-a-half years ago (June 23, 2016).

With different constituents vying for complete Brexit, partial Brexit with a backstop, no Brexit, and other variants, the argument over how to implement what was voted upon by the constituency has been nothing short of a disaster and an indictment against the effectiveness of government everywhere.

Somebody should point out - we will - that with all the Brexit juggling, partial US shutdown jousting, and continuing French protesting, governments in developed nations are proving to be at least cracked, if not nearly completely broken. Besides the fact that none of them can manage to spend less than what they receive through their extreme, excessive, heavy-handed taxation - which is over the top - it seems all they're capable of doing at the highest levels is fight for positioning and power, all to the detriment of the people they're supposed to be representing. Collectively, they pass no new legislation that is of benefit to the people. Other than President Trump's efforts, government is a massive, obvious failure of human capacity.

If ever there was a time for a global revolution (not a new concept), it would be now, though nobody has any contingency plans for how to deal with the dystopian aftermath that would surely follow.

Experience teaches us that disposing of scoundrels, deposing tyrants, or overthrowing governments only makes matters seem better for a short period of time. At least in the original American revolution, the patriots were separated from their tyrannical rulers by a vast ocean which technology hadn't quite conquered.

Today's intertwined system is different, close at hand, and the scoundrels much better disguised. There isn't going to be any overthrow of anything except morals and values, people's faith and judgment, which seem to be going in the direction of all flesh. Anger, the most palpable manifestation of displeasure, is boiling over in all facets of urban life. People are becoming more and more ill-mannered, short-tempered, self-absorbed, and intolerant toward the views and objectives of others. All of this adds up to uncivil activities, flouting of the law, violence and strife. Essentially, when ordinary people lose faith in a government that they had become accustomed to relying upon, all that's left is chaos, and that seems to be the direction in which we're inexorably, sadly, headed.

... and then came the Brexit vote in Britain's Parliament. Prime Minister Teresa May's government proposal was rounded defeated by a 432-202 vote in the House of Commons. On the news, the Dow tanked... briefly, the other indices slumped shortly, and then shot back to from whence they came.

It's all fake, people. There are no more free markets. Face it. All the geese been thoroughly cooked.

What may be happening is that humans are programming computer algorithms to react to fake news and the PPT is backstopping each and every tick lower by buying futures, resulting in the altos readjusting to buy more.

There was a good deal of bad news flow in the morning... and then just after 7:00 pm London time (2:00 pm ET), there was the Brexit vote.

Here's what passed across the wires prior to the opening bell and shortly thereafter:

- Both Wells Fargo (WFC) and JP Morgan Chase (JPM) missed on both earnings per share and revenue.

- Netflix (NFLX) announced the largest price increase in its 12-year history.

- China's economy grew by 6.4%, the slowest rate in over a decade.

- PPI cane in at -0.2%, a deflationary reading.

- Delta Airlines (DAL) beat, but warned that the partial government shutdown would negatively impact earnings in the current quarter.

- The Empire State Manufacturing Survey fell to a reading of 3.9 in January from an upwardly revised reading of 11.5 in December.

- Goodyear Tire (GT) lowered its fourth quarter outlook and full year (2018) guidance.

With all this in the cooker, stocks opened higher and took off from there. The Dow exploded to a gain of 190 points just before noon. The NASDAQ was up nearly 120 points.

After noon, the markets went into a wait-and-see mood as the Brexit vote approached. In what has to be the most convoluted, time-wasting exercise in government over-reach (possibly challenged by the partial shutdown in the US), Britain has been wrangling over just how to depart from the European Union after a referendum passed nearly two-and-a-half years ago (June 23, 2016).

With different constituents vying for complete Brexit, partial Brexit with a backstop, no Brexit, and other variants, the argument over how to implement what was voted upon by the constituency has been nothing short of a disaster and an indictment against the effectiveness of government everywhere.

Somebody should point out - we will - that with all the Brexit juggling, partial US shutdown jousting, and continuing French protesting, governments in developed nations are proving to be at least cracked, if not nearly completely broken. Besides the fact that none of them can manage to spend less than what they receive through their extreme, excessive, heavy-handed taxation - which is over the top - it seems all they're capable of doing at the highest levels is fight for positioning and power, all to the detriment of the people they're supposed to be representing. Collectively, they pass no new legislation that is of benefit to the people. Other than President Trump's efforts, government is a massive, obvious failure of human capacity.

If ever there was a time for a global revolution (not a new concept), it would be now, though nobody has any contingency plans for how to deal with the dystopian aftermath that would surely follow.

Experience teaches us that disposing of scoundrels, deposing tyrants, or overthrowing governments only makes matters seem better for a short period of time. At least in the original American revolution, the patriots were separated from their tyrannical rulers by a vast ocean which technology hadn't quite conquered.

Today's intertwined system is different, close at hand, and the scoundrels much better disguised. There isn't going to be any overthrow of anything except morals and values, people's faith and judgment, which seem to be going in the direction of all flesh. Anger, the most palpable manifestation of displeasure, is boiling over in all facets of urban life. People are becoming more and more ill-mannered, short-tempered, self-absorbed, and intolerant toward the views and objectives of others. All of this adds up to uncivil activities, flouting of the law, violence and strife. Essentially, when ordinary people lose faith in a government that they had become accustomed to relying upon, all that's left is chaos, and that seems to be the direction in which we're inexorably, sadly, headed.

... and then came the Brexit vote in Britain's Parliament. Prime Minister Teresa May's government proposal was rounded defeated by a 432-202 vote in the House of Commons. On the news, the Dow tanked... briefly, the other indices slumped shortly, and then shot back to from whence they came.

It's all fake, people. There are no more free markets. Face it. All the geese been thoroughly cooked.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

| 1/9/19 | 23,879.12 | +91.67 | +551.66 |

| 1/10/19 | 24,001.92 | +122.80 | +674.46 |

| 1/11/19 | 23,995.95 | -5.97 | +669.49 |

| 1/14/19 | 23,909.84 | -86.11 | +583.38 |

| 1/15/19 | 24,065.59 | +155.75 | +739.13 |

At the Close, Tuesday, January 15, 2019:

Dow Jones Industrial Average: 24,065.59, +155.75 (+0.65%)

NASDAQ: 7,023.83, +117.92 (+1.71%)

S&P 500: 2,610.30, +27.69 (+1.07%)

NYSE Composite: 11,868.68, +69.57 (+0.59%)

Monday, January 14, 2019

Dull Monday

Stocks took a negative turn on Monday, with no rationale for the move other than general sentiment. Citigroup (C) missed on revenue when they announced fourth quarter earnings prior to the opening bell.

More bank stocks will be reporting as the week progresses, so this small downdraft may be just the start of something larger. The major indices seem to be nearly out of steam from the recent rally. Expectations for earnings season have been muted, and some earnings and revenue misses are to be expected, and, if that's the case, nothing kills rallies better than earnings misses.

Stay tuned.

Dow Jones Industrial Average January Scorecard:

At the Close, Monday, January 14, 2019:

Dow Jones Industrial Average: 23,909.84, -86.11 (-0.36%)

NASDAQ: 6,905.92, -65.56 (-0.94%)

S&P 500: 2,582.61, -13.65 (-0.53%)

NYSE Composite: 11,799.11, -48.90 (-0.41%)

More bank stocks will be reporting as the week progresses, so this small downdraft may be just the start of something larger. The major indices seem to be nearly out of steam from the recent rally. Expectations for earnings season have been muted, and some earnings and revenue misses are to be expected, and, if that's the case, nothing kills rallies better than earnings misses.

Stay tuned.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

| 1/9/19 | 23,879.12 | +91.67 | +551.66 |

| 1/10/19 | 24,001.92 | +122.80 | +674.46 |

| 1/11/19 | 23,995.95 | -5.97 | +669.49 |

| 1/14/19 | 23,909.84 | -86.11 | +583.38 |

At the Close, Monday, January 14, 2019:

Dow Jones Industrial Average: 23,909.84, -86.11 (-0.36%)

NASDAQ: 6,905.92, -65.56 (-0.94%)

S&P 500: 2,582.61, -13.65 (-0.53%)

NYSE Composite: 11,799.11, -48.90 (-0.41%)

Sunday, January 13, 2019

Weekend Wrap: The Fed Never Had Control, And What They Now Have Is As Fake As Fake News

What a week it was for equity holders and speculators!

Friday's very minor declines snapped five-day winning streaks for the major indices, with the exception of the NYSE Composite, which continued gaining for a sixth straight session.

Solid for the past three weeks, the current rally has managed to relieve the stress from steep losses incurred in December though the majors still have plenty of distance to travel. For instance, the Dow Jones Industrial Average lost 4034.23 from December 4 through Christmas Eve (Dec. 24), and has since gained 2203.75, nearly half of that amount regained the day after Christmas (Dec. 26), setting a one-day record by picking up 1086.25 points.

The other indices have exhibited similar patterns, with sudden acceleration in the final trading days of December and continuing smaller, albeit significant, positive closes on nine of the twelve sessions from December 26 through January 11.

Catalysts for the post-holiday rally continue to be diverse, the most significant strong data point coming from the BLS, which showed the economy adding 312,000 jobs for December in the most recent non-farm payroll report, released last Friday. So far beyond expectations was that number that it appeared to have kept sentiment positive for a full week after its release.

The week's most important data release was Friday's CPI number, which - thanks largely to the price of gasoline - declined 0.1% in December, and slowed to 1.9% in year-over-year measure. Core was +0.2% (mom) and +2.2% (yoy).

Slowing inflation, or perhaps, outright deflation, is anathema to the Federal Reserve, despite their all-too-frequent suggestions that they exist to keep inflation under check. The entire monetary scheme of the Fed and the global economy would disintegrate without inflation, thus the Fed will be diligent in regards to interest rates going forward. After hiking the federal funds rate at a pace of 25 basis points per quarter for the past two years, the Fed has received warnings aplenty, first from the cascading declines in the stock market, and second, from a squashing of inflation.

That CPI data, for all intents and purposes, killed any idea of a March rate hike, just as the market drop caused Treasury Secretary Mnuchin to frantically call in the Plunge Protection Team just before Christmas. The results from that plea for help have been grossly evident the past three weeks.

While the Fed believes it can control the economy, the truth is that it absolutely cannot. Bond prices and yields point that out in spades. The benchmark 10-year note yield dropped as low as 2.54% (1/3) in the face of all the recent rate hikes. As of Friday, the 2s-10s spread fell to 16 basis points. Already inverted are the 1-year and 2-year notes as related to the 5s. The 1-year closed on Friday with a yield of 2.58%; the 2-year at 2.55%; the 5-year at 2.52%, the 7-year at 2.60, and the 10-year at 2.60%.

The 2s-10s spread is the most cited and closely watched, but the 1s-7s are just two basis points from inversion, the cause, undeniably, the Fed's incessant pimping of the overnight rate.

If bond traders are acting in such a manner that they prefer short-dated maturities over the longer run, the signal is danger just ahead. Talk of an impending recession has tapered off in recent days, but the bond market's insistent buying patterns suggest that the Fed did indeed go too far, too fast with the rate hikes, spurring disinvestment and eventually, a recession.

What the Fed cannot control are human decisions. Noting the sentiment in bonds, the latest stock market gains have been contrived from the start and are certain to reverse course. As has been stated here countless times, bull markets do not last forever and Dow Theory has already signaled primary trend change twice in 2018 (in March-April and October).

The major indices have not escaped correction territory and all are trading below both their 50-and-200-day moving averages. Further those averages are upside-down, with the 200-day below the 50-day. The death crosses having already occurred, stocks will resume their reversion to the mean in the very near future.

Dow Jones Industrial Average January Scorecard:

At the Close, Friday, January 11, 2019:

Dow Jones Industrial Average: 23,995.95, -5.97 (-0.02%)

NASDAQ: 6,971.48, -14.59 (-0.21%)

S&P 500: 2,596.26, -0.38 (-0.01%)

NYSE Composite: 11,848.01, +8.70 (+0.07%)

For the Week:

Dow: +562.79 (+2.40%)

NASDAQ: +232.62 (+3.45%)

S&P 500: +64.32 (+2.54%)

NYSE Composite: +314.67 (+2.73%)

Friday's very minor declines snapped five-day winning streaks for the major indices, with the exception of the NYSE Composite, which continued gaining for a sixth straight session.

Solid for the past three weeks, the current rally has managed to relieve the stress from steep losses incurred in December though the majors still have plenty of distance to travel. For instance, the Dow Jones Industrial Average lost 4034.23 from December 4 through Christmas Eve (Dec. 24), and has since gained 2203.75, nearly half of that amount regained the day after Christmas (Dec. 26), setting a one-day record by picking up 1086.25 points.

The other indices have exhibited similar patterns, with sudden acceleration in the final trading days of December and continuing smaller, albeit significant, positive closes on nine of the twelve sessions from December 26 through January 11.

Catalysts for the post-holiday rally continue to be diverse, the most significant strong data point coming from the BLS, which showed the economy adding 312,000 jobs for December in the most recent non-farm payroll report, released last Friday. So far beyond expectations was that number that it appeared to have kept sentiment positive for a full week after its release.

The week's most important data release was Friday's CPI number, which - thanks largely to the price of gasoline - declined 0.1% in December, and slowed to 1.9% in year-over-year measure. Core was +0.2% (mom) and +2.2% (yoy).

Slowing inflation, or perhaps, outright deflation, is anathema to the Federal Reserve, despite their all-too-frequent suggestions that they exist to keep inflation under check. The entire monetary scheme of the Fed and the global economy would disintegrate without inflation, thus the Fed will be diligent in regards to interest rates going forward. After hiking the federal funds rate at a pace of 25 basis points per quarter for the past two years, the Fed has received warnings aplenty, first from the cascading declines in the stock market, and second, from a squashing of inflation.

That CPI data, for all intents and purposes, killed any idea of a March rate hike, just as the market drop caused Treasury Secretary Mnuchin to frantically call in the Plunge Protection Team just before Christmas. The results from that plea for help have been grossly evident the past three weeks.

While the Fed believes it can control the economy, the truth is that it absolutely cannot. Bond prices and yields point that out in spades. The benchmark 10-year note yield dropped as low as 2.54% (1/3) in the face of all the recent rate hikes. As of Friday, the 2s-10s spread fell to 16 basis points. Already inverted are the 1-year and 2-year notes as related to the 5s. The 1-year closed on Friday with a yield of 2.58%; the 2-year at 2.55%; the 5-year at 2.52%, the 7-year at 2.60, and the 10-year at 2.60%.

The 2s-10s spread is the most cited and closely watched, but the 1s-7s are just two basis points from inversion, the cause, undeniably, the Fed's incessant pimping of the overnight rate.

If bond traders are acting in such a manner that they prefer short-dated maturities over the longer run, the signal is danger just ahead. Talk of an impending recession has tapered off in recent days, but the bond market's insistent buying patterns suggest that the Fed did indeed go too far, too fast with the rate hikes, spurring disinvestment and eventually, a recession.

What the Fed cannot control are human decisions. Noting the sentiment in bonds, the latest stock market gains have been contrived from the start and are certain to reverse course. As has been stated here countless times, bull markets do not last forever and Dow Theory has already signaled primary trend change twice in 2018 (in March-April and October).

The major indices have not escaped correction territory and all are trading below both their 50-and-200-day moving averages. Further those averages are upside-down, with the 200-day below the 50-day. The death crosses having already occurred, stocks will resume their reversion to the mean in the very near future.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

| 1/9/19 | 23,879.12 | +91.67 | +551.66 |

| 1/10/19 | 24,001.92 | +122.80 | +674.46 |

| 1/11/19 | 23,995.95 | -5.97 | +669.49 |

At the Close, Friday, January 11, 2019:

Dow Jones Industrial Average: 23,995.95, -5.97 (-0.02%)

NASDAQ: 6,971.48, -14.59 (-0.21%)

S&P 500: 2,596.26, -0.38 (-0.01%)

NYSE Composite: 11,848.01, +8.70 (+0.07%)

For the Week:

Dow: +562.79 (+2.40%)

NASDAQ: +232.62 (+3.45%)

S&P 500: +64.32 (+2.54%)

NYSE Composite: +314.67 (+2.73%)

Thursday, January 10, 2019

Retail Woes Subdued By Dip Buyers; Stocks Continue New Year Rally

Stocks have been on quite a tear since Christmas, a move that is strangely similar to hmmmm... last January.

How did that turn out?

Since the big downdraft of December, which culminated in a major splashdown on Christmas Eve, the Dow, NASDAQ and S&P 500 have staged a rally that is remarkable if only for its vacuousness. The only reasonable rationale for the recovery rally is that stocks were down so much, they looked like bargains. Oddly enough, many of these same stocks - names like Amazon (AMZN), Apple (AAPL) and Facebook (FB) - were being unloaded like cabbage off a produce truck just weeks ago.

These companies aren't doing any better than they were in November or December, nor is the economy. Even worse, the government shutdown, which began just before the markets bottomed, has continued, its effects so far minimized. The shutdown only affects about a quarter of "non-essential" federal operations, so it has not been a major headache for many. In a month or two, however, even if the shutdown ends soon, there will be some material and psychological damage to the economy, that's without a doubt. Plans were changed, the federal employees who were either furloughed or working without pay had problems making ends meet, and the general populace grimaced, frowned, and variously expressed disgust at the government's dysfunction.

So, the choice is whether to engage in the buying or await a better entry point, or, since stocks are up broadly in the nearly three weeks since Christmas, go short.

For now, the waiting game may be the most prudent, unless one has an economic itch that is in need of a scratch, especially since today's action saw a heavy downdraft at the open due to failures in the retail space, particularly Macy's (M) and Kohl's (KSS), both of which reported disappointing same store sales over the holidays.

Macy's was sacrificed to the tune of a 17% decline on the day, while Kohl's, down nearly 10% early, finished with a loss that was half that, thanks to the dip buyers de jour.

If this continues, all stocks will eventually be bought, at some price, regardless of fundamentals. Certainly, Macy's is now going to be seen as ripe for the plucking by somebody.

Dow Jones Industrial Average January Scorecard:

At the Close, Thursday, January 10, 2019:

Dow Jones Industrial Average: 24,001.92, +122.80 (+0.51%)

NASDAQ: 6,986.07, +28.99 (+0.42%)

S&P 500: 2,596.64, +11.68 (+0.45%)

NYSE Composite: 11,839.31, +60.89 (+0.52%)

How did that turn out?

Since the big downdraft of December, which culminated in a major splashdown on Christmas Eve, the Dow, NASDAQ and S&P 500 have staged a rally that is remarkable if only for its vacuousness. The only reasonable rationale for the recovery rally is that stocks were down so much, they looked like bargains. Oddly enough, many of these same stocks - names like Amazon (AMZN), Apple (AAPL) and Facebook (FB) - were being unloaded like cabbage off a produce truck just weeks ago.

These companies aren't doing any better than they were in November or December, nor is the economy. Even worse, the government shutdown, which began just before the markets bottomed, has continued, its effects so far minimized. The shutdown only affects about a quarter of "non-essential" federal operations, so it has not been a major headache for many. In a month or two, however, even if the shutdown ends soon, there will be some material and psychological damage to the economy, that's without a doubt. Plans were changed, the federal employees who were either furloughed or working without pay had problems making ends meet, and the general populace grimaced, frowned, and variously expressed disgust at the government's dysfunction.

So, the choice is whether to engage in the buying or await a better entry point, or, since stocks are up broadly in the nearly three weeks since Christmas, go short.

For now, the waiting game may be the most prudent, unless one has an economic itch that is in need of a scratch, especially since today's action saw a heavy downdraft at the open due to failures in the retail space, particularly Macy's (M) and Kohl's (KSS), both of which reported disappointing same store sales over the holidays.

Macy's was sacrificed to the tune of a 17% decline on the day, while Kohl's, down nearly 10% early, finished with a loss that was half that, thanks to the dip buyers de jour.

If this continues, all stocks will eventually be bought, at some price, regardless of fundamentals. Certainly, Macy's is now going to be seen as ripe for the plucking by somebody.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

| 1/9/19 | 23,879.12 | +91.67 | +551.66 |

| 1/10/19 | 24,001.92 | +122.80 | +674.46 |

At the Close, Thursday, January 10, 2019:

Dow Jones Industrial Average: 24,001.92, +122.80 (+0.51%)

NASDAQ: 6,986.07, +28.99 (+0.42%)

S&P 500: 2,596.64, +11.68 (+0.45%)

NYSE Composite: 11,839.31, +60.89 (+0.52%)

Wednesday, January 9, 2019

Stocks Keep Rising, But Major Speed Bumps Are Dead Ahead

Bored yet?

Since bottoming out the day before Christmas (December 24), the major US indices have gained in eight of the last ten sessions, including today's smallish gains.

While going eight for ten to the upside certainly sounds impressive, there is a small problem. The NASDAQ. S&P 500, Dow Industrials, and NYSE Composite are all trading below their 50-and-200-day moving averages. What's more troubling is that those averages are inverted, with the 50 below the 200, as all of the charts show the so-called "death cross" occurring variously between late November and mid-December.

This is troubling to chartists because the rallies have produced some ill-placed optimism in the minds of some investors, mostly affecting those passive types with 401k, retirement, IRA and other "hands off" accounts.

So, while everybody is cheering the fantastic performance of stocks in the new year, there are major speed bumps dead ahead. Turning around inverted moving averages is the kind of heavy lifting for which the PPT was created and how the Fed came up with various forms of money creation, such as QE, QE2, Operation Twist, and other variants of magical fiat money.

Earnings season is about to kick into high gear next week, and expectations are not all that rosy, though, if one tracks home builders, like Lennar (LEN), which missed expectations but still managed a gain today of nearly eight percent. Of course, the stock is just off its 52-week low, so there's an outside chance that everybody, all at once decided it was too cheap to pass up.

So, the question is whether the PPT or the Fed or the Bank of Japan or the ECB, or all of them are of like mind and will buy with open arms every stock that looks like a sure loser over the next four to five weeks.

There's an old adage in the investing world, that posits, "don't fight the Fed." This time it appears to be for real and the Fed, from the speeches and off-the-cuff quotes by some of the regional presidents, is in a fighting mood.

Dow Jones Industrial Average January Scorecard:

At the Close, Wednesday, January 9, 2018:

Dow Jones Industrial Average: 23,879.12, +91.67 (+0.39%)

NASDAQ: 6,957.08, +60.08 (+0.87%)

S&P 500: 2,584.96, +10.55 (+0.41%)

NYSE Composite: 11,778.42, +62.19 (+0.53%)

Since bottoming out the day before Christmas (December 24), the major US indices have gained in eight of the last ten sessions, including today's smallish gains.

While going eight for ten to the upside certainly sounds impressive, there is a small problem. The NASDAQ. S&P 500, Dow Industrials, and NYSE Composite are all trading below their 50-and-200-day moving averages. What's more troubling is that those averages are inverted, with the 50 below the 200, as all of the charts show the so-called "death cross" occurring variously between late November and mid-December.

This is troubling to chartists because the rallies have produced some ill-placed optimism in the minds of some investors, mostly affecting those passive types with 401k, retirement, IRA and other "hands off" accounts.

So, while everybody is cheering the fantastic performance of stocks in the new year, there are major speed bumps dead ahead. Turning around inverted moving averages is the kind of heavy lifting for which the PPT was created and how the Fed came up with various forms of money creation, such as QE, QE2, Operation Twist, and other variants of magical fiat money.

Earnings season is about to kick into high gear next week, and expectations are not all that rosy, though, if one tracks home builders, like Lennar (LEN), which missed expectations but still managed a gain today of nearly eight percent. Of course, the stock is just off its 52-week low, so there's an outside chance that everybody, all at once decided it was too cheap to pass up.

So, the question is whether the PPT or the Fed or the Bank of Japan or the ECB, or all of them are of like mind and will buy with open arms every stock that looks like a sure loser over the next four to five weeks.

There's an old adage in the investing world, that posits, "don't fight the Fed." This time it appears to be for real and the Fed, from the speeches and off-the-cuff quotes by some of the regional presidents, is in a fighting mood.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

| 1/9/19 | 23,879.12 | +91.67 | +551.66 |

At the Close, Wednesday, January 9, 2018:

Dow Jones Industrial Average: 23,879.12, +91.67 (+0.39%)

NASDAQ: 6,957.08, +60.08 (+0.87%)

S&P 500: 2,584.96, +10.55 (+0.41%)

NYSE Composite: 11,778.42, +62.19 (+0.53%)

Tuesday, January 8, 2019

PPT And/Or The Fed Working Overtime To Keep Stocks Elevated

Not exactly proof, but here's a mainstream article calling out the central banks for market intervention, otherwise known as manipulation, or, preventing a crash.

Call it anything you want, including PPT, but there are surely unseen forces at work. Consider, if you will, that since central banks have the power to goose markets upwards, they also possess the power to depress them. Sobering thought, isn't it?

Valuation will become a concern this year as soon as earnings reports commence. First quarter reports may not be all that impactful, but second quarter corporate earnings and revenue reports may validate the theory that a combination of easy fed policies, low interest rates, buybacks, and a willingness to believe that the Fed would backstop any sizable decline were responsible for the last ten years of gains.

If some of the more astute forecasters are correct, an earnings and profit recession is due sometime in 2019, and the likelihood of such an occurrence will accelerate throughout the year. If corporations are going to slow down in 2019, stocks should follow, but, in the parallel universe that has become Wall Street and end of the business cycle as we once knew it, anything could happen.

The rally since Christmas appears to be based on just about nothing. Noting that, how long it will last has only one correct solution. Out will last until holders of stocks find a comfortable exit price because the major indices are still in correction.

Dow Jones Industrial Average January Scorecard:

At the Close, Tuesday, January 8, 2019:

Dow Jones Industrial Average: 23,787.45, +256.10 (+1.09%)

NASDAQ: 6,897.00, +73.53 (+1.08%)

S&P 500: 2,574.41, +24.72 (+0.97%)

NYSE Composite: 11,716.23, +110.27 (+0.95%)

Call it anything you want, including PPT, but there are surely unseen forces at work. Consider, if you will, that since central banks have the power to goose markets upwards, they also possess the power to depress them. Sobering thought, isn't it?

Valuation will become a concern this year as soon as earnings reports commence. First quarter reports may not be all that impactful, but second quarter corporate earnings and revenue reports may validate the theory that a combination of easy fed policies, low interest rates, buybacks, and a willingness to believe that the Fed would backstop any sizable decline were responsible for the last ten years of gains.

If some of the more astute forecasters are correct, an earnings and profit recession is due sometime in 2019, and the likelihood of such an occurrence will accelerate throughout the year. If corporations are going to slow down in 2019, stocks should follow, but, in the parallel universe that has become Wall Street and end of the business cycle as we once knew it, anything could happen.

The rally since Christmas appears to be based on just about nothing. Noting that, how long it will last has only one correct solution. Out will last until holders of stocks find a comfortable exit price because the major indices are still in correction.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

| 1/8/19 | 23,787.45 | +256.10 | +459.99 |

At the Close, Tuesday, January 8, 2019:

Dow Jones Industrial Average: 23,787.45, +256.10 (+1.09%)

NASDAQ: 6,897.00, +73.53 (+1.08%)

S&P 500: 2,574.41, +24.72 (+0.97%)

NYSE Composite: 11,716.23, +110.27 (+0.95%)

Labels:

central banks,

correction,

Federal Reserve,

manipulation

Monday, January 7, 2019

Volatility Tamped Down By PPT A Probable Cause For Monday's Dullness

Chip stocks (NVDA, ADM) led the big gain on the NASDAQ, but the session overall was lackluster, with a dip at the open and a weak close.

Investors are still unconvinced the volatility of the past few months has abated. Today felt more like a temporary reprieve rather than a new paradigm. There's also the very good possibility that the Plunge Protection Team (PPT) is still active, especially considering the quick turnaround this morning. It was classic insider action, like hitting sellers over the head with a sledgehammer.

The PPT has absolutely no subtlety about it which makes their intrusions somewhat obvious, as has always been the case, even back in the days when people thought they were a myth or some kind of financial urban legend. As it turned out, the PPT was always a real thing, and a threat to fair, unmolested, open markets. Now that they've been out in the open for at least a decade, not much is left to the imagination. US markets - and, likely, almost every other market in the world - have been highly manipulated by central banks and governments working in cahoots and that's unlikely to end soon.

With friends like these in markets and the preponderance of investments in stocks, investing today is riskier than it has ever been. Who wants to play in a casino knowing that the dealer has the ability to cheat at any time? As unsuitable as it is for large money players to intervene at times of crisis, it's even worse when they do so at the drop of a hat, or, as the case may be, a few thousand points on the Dow.

It's not pleasant to witness wild swings in entire indices on a regular basis, which is why so many individual investors are so jaded. They know their money is at extreme risk all the time. There has to be a better way, and there used to be, prior to the financialization era we currently are enduring, before everything from mom's mortgage to pizza stocks are part and parcel of every fund's basic needs.

The trouble with markets today are the real probability that in the case of an extended bear market, the entire global financial system would simply implode. It keeps more than just a few heads at the IMF, BIS, and the Fed from sleeping well at night.

Dow Jones Industrial Average January Scorecard:

At the Close, Monday, January 7, 2019:

Dow Jones Industrial Average: 23,531.35, +98.19 (+0.42%)

NASDAQ: 6,823.47, +84.61 (+1.26%)

S&P 500: 2,549.69, +17.75 (+0.70%)

NYSE Composite: 11,605.96, +72.62 (+0.63)

Investors are still unconvinced the volatility of the past few months has abated. Today felt more like a temporary reprieve rather than a new paradigm. There's also the very good possibility that the Plunge Protection Team (PPT) is still active, especially considering the quick turnaround this morning. It was classic insider action, like hitting sellers over the head with a sledgehammer.

The PPT has absolutely no subtlety about it which makes their intrusions somewhat obvious, as has always been the case, even back in the days when people thought they were a myth or some kind of financial urban legend. As it turned out, the PPT was always a real thing, and a threat to fair, unmolested, open markets. Now that they've been out in the open for at least a decade, not much is left to the imagination. US markets - and, likely, almost every other market in the world - have been highly manipulated by central banks and governments working in cahoots and that's unlikely to end soon.

With friends like these in markets and the preponderance of investments in stocks, investing today is riskier than it has ever been. Who wants to play in a casino knowing that the dealer has the ability to cheat at any time? As unsuitable as it is for large money players to intervene at times of crisis, it's even worse when they do so at the drop of a hat, or, as the case may be, a few thousand points on the Dow.

It's not pleasant to witness wild swings in entire indices on a regular basis, which is why so many individual investors are so jaded. They know their money is at extreme risk all the time. There has to be a better way, and there used to be, prior to the financialization era we currently are enduring, before everything from mom's mortgage to pizza stocks are part and parcel of every fund's basic needs.

The trouble with markets today are the real probability that in the case of an extended bear market, the entire global financial system would simply implode. It keeps more than just a few heads at the IMF, BIS, and the Fed from sleeping well at night.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

| 1/7/19 | 23,531.35 | +98.19 | +203.89 |

At the Close, Monday, January 7, 2019:

Dow Jones Industrial Average: 23,531.35, +98.19 (+0.42%)

NASDAQ: 6,823.47, +84.61 (+1.26%)

S&P 500: 2,549.69, +17.75 (+0.70%)

NYSE Composite: 11,605.96, +72.62 (+0.63)

Saturday, January 5, 2019

Weekend Wrap: Friday's Big Gains Offset Thursday's Huge Loss, Dow Up Just 105 In 2019

Wall Street's week straddled 2018 and 2019, as Monday's session was the last of the prior year, and Wednesday, Thursday, and Friday starting off the new year.

Thus, the following final closing prices for the major indices, which will be instructive as we plow through the weeks, months, and quarters ahead:

Dow Industrials 12/31/18: 23,327.46

Dow Transports 12/31/18: 9,170.40

NASDAQ 12/31/18: 6,635.28

S&P 500 12/31/18: 2,506.85

NYSE Composite 12/31/18: 11,374.39

Two big trading days happened back-to-back, in opposite directions. Thursday's (1/3) downdraft was largely attributable to Apple's announcement that revenue for its fiscal first quarter (4th quarter) results would come in well below analyst estimates. December PMI from the ISM was also a contributing factor, insinuating a slowdown in the general economy, much of it tied to US-China trade tensions.

A blowout December jobs report was responsible Friday's about-face. Words from Fed Chairman Jerome Powell added fuel to the ascending fire. Powell stated quite plainly that the Fed was going to be flexible about raising rates and drawing down its balance sheet, which is pulling $50 billion a month out of the bond market.

After all was said and done, the week was just so-so, though the bias was obviously trending positive. There's some inkling of manipulation and coordination of and by the PPT, especially since the Fed was so compliant with its dovish commentary. Nobody really wants a bear market, and the data from Friday's release of the December non-farm payroll report (312K actual vs. 122K projected) suggests that the economy is humming right along and President Trump's promise to create more US jobs is being kept.

The Fed's jawboning was well-timed, coming a day after a confidence-shaking 660-point drop on the Dow, but the remarks by Chairman Powell won't be the last time the Fed has moved the goal posts in search of expediency.

Dow Jones Industrial Average January Scorecard:

At the Close, Friday, January 4, 2019:

Dow Jones Industrial Average: 23,433.16, +746.94 (+3.29%)

NASDAQ: 6,738.86, +275.35 (+4.26%)

S&P 500: 2,531.94, +84.05 (+3.43%)

NYSE Composite: 11,533.34, +342.90 (+3.06%)

For the Week:

Dow: +370.76 (+1.61%)

NASDAQ: +154.34 (+2.34%)

S&P 500: +46.20 (+1.86%)

NYSE Composite: +242.39 (+2.15%)

Thus, the following final closing prices for the major indices, which will be instructive as we plow through the weeks, months, and quarters ahead:

Dow Industrials 12/31/18: 23,327.46

Dow Transports 12/31/18: 9,170.40

NASDAQ 12/31/18: 6,635.28

S&P 500 12/31/18: 2,506.85

NYSE Composite 12/31/18: 11,374.39

Two big trading days happened back-to-back, in opposite directions. Thursday's (1/3) downdraft was largely attributable to Apple's announcement that revenue for its fiscal first quarter (4th quarter) results would come in well below analyst estimates. December PMI from the ISM was also a contributing factor, insinuating a slowdown in the general economy, much of it tied to US-China trade tensions.

A blowout December jobs report was responsible Friday's about-face. Words from Fed Chairman Jerome Powell added fuel to the ascending fire. Powell stated quite plainly that the Fed was going to be flexible about raising rates and drawing down its balance sheet, which is pulling $50 billion a month out of the bond market.

After all was said and done, the week was just so-so, though the bias was obviously trending positive. There's some inkling of manipulation and coordination of and by the PPT, especially since the Fed was so compliant with its dovish commentary. Nobody really wants a bear market, and the data from Friday's release of the December non-farm payroll report (312K actual vs. 122K projected) suggests that the economy is humming right along and President Trump's promise to create more US jobs is being kept.

The Fed's jawboning was well-timed, coming a day after a confidence-shaking 660-point drop on the Dow, but the remarks by Chairman Powell won't be the last time the Fed has moved the goal posts in search of expediency.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

| 1/4/19 | 23,433.16 | +746.94 | +105.70 |

At the Close, Friday, January 4, 2019:

Dow Jones Industrial Average: 23,433.16, +746.94 (+3.29%)

NASDAQ: 6,738.86, +275.35 (+4.26%)

S&P 500: 2,531.94, +84.05 (+3.43%)

NYSE Composite: 11,533.34, +342.90 (+3.06%)

For the Week:

Dow: +370.76 (+1.61%)

NASDAQ: +154.34 (+2.34%)

S&P 500: +46.20 (+1.86%)

NYSE Composite: +242.39 (+2.15%)

Labels:

balance sheet,

Federal Reserve,

interest rates,

ISM,

Jerome Powell,

non-farm payroll,

PMI,

PPT,

President Trump

Thursday, January 3, 2019

Stocks Slammed, Bonds Rally As Global Slowdown Fears Rise

Apple computer, maker of the iconic iPhone, was the cause of much of today's equity angst, as the tech giant warned that fourth quarter sales were likely to come in under revenue estimates.

Apple CEO Tim Cook issued a letter late Wednesday to investors advising that a slowdown in China sales would cause fourth quarter revenue to decline 4.8% year over year to $84 billion, well below analyst estimates. It's not that Apple is losing money - far from that - it's just not making as much as expected. Shares of Apple (AAPL) were down nearly 10% on the news, the largest one-day loss in six years.

Combined with a report from the Institute for Supply Management (ISM) that had December's PMI fall by the most since the financial crisis of 2008, stocks were on the defensive all day long. The report concluded that December PMI fell from 59.3 to 54.1, a descent of 5.4%. While anything over 50 is considered expansion, the falloff is considered to be a harbinger of worse data to come, as many participants in the survey blamed trade tensions with China as a leading cause for the slowdown.

Thus, the 1000+ point gain from December 26 was cut down by two-thirds on Thursday, just a week later, sending the Dow and other major indices closer to bear market territory once again.

January has gotten off to a horrible start, as though December's rout hadn't ended, which, of course, would be correct. Losses on stocks are only just beginning. By March of this year, expect stocks to be another 10-15% lower than where they stand today, and, even then, with signs of a global slowdown flashing red, a bottom won't likely be put in until the market has flushed out all of the weak hands and sent fund managers scurrying in even greater numbers to cash and bonds.

Presently, the treasuries are telling an interesting story about the economy. While the Federal Reserve insisted on raising rates four times in 2019, the bond market has expressed extreme displeasure, sending the yield on the 10-year note to 2.56%, down ten basis points just today, marking the lowest yield since January of last year. Additionally, short-maturity bills spiked (thanks to Fed hikes at the low end) with the one-year yielding 2.50%, as compared to 2.39% for the 2-year and 2.37% for the five-year note. Inversion in accelerating at the short end of the curve.

While this is traditionally not the pairs that signal recession, that distinction belonging to the 2s-10s spread, it is highly unusual. Bond traders are saying they don't want to issue longer-term, for fear that the economy will weaken as time progresses. The 30-year also was slammed lower, yielding 2.92%, down five basis points from yesterday.

2019 is looking to be an even worse year for equity investors, and a rout in the stock market could cause panic to spread to many diverse levels of economic activity. A recession within the next three to twelve months is looking more a certainty with each passing day.

Dow Jones Industrial Average January Scorecard:

At the Close, Thursday, January 3, 2019:

Dow Jones Industrial Average: 22,686.22, -660.02 (-2.83%)

NASDAQ: 6,463.50, -202.43 (-3.04%)

S&P 500: 2,447.89, -62.14 (-2.48%)

NYSE Composite: 11,190.44, -193.09 (-1.70%)

Apple CEO Tim Cook issued a letter late Wednesday to investors advising that a slowdown in China sales would cause fourth quarter revenue to decline 4.8% year over year to $84 billion, well below analyst estimates. It's not that Apple is losing money - far from that - it's just not making as much as expected. Shares of Apple (AAPL) were down nearly 10% on the news, the largest one-day loss in six years.

Combined with a report from the Institute for Supply Management (ISM) that had December's PMI fall by the most since the financial crisis of 2008, stocks were on the defensive all day long. The report concluded that December PMI fell from 59.3 to 54.1, a descent of 5.4%. While anything over 50 is considered expansion, the falloff is considered to be a harbinger of worse data to come, as many participants in the survey blamed trade tensions with China as a leading cause for the slowdown.

Thus, the 1000+ point gain from December 26 was cut down by two-thirds on Thursday, just a week later, sending the Dow and other major indices closer to bear market territory once again.

January has gotten off to a horrible start, as though December's rout hadn't ended, which, of course, would be correct. Losses on stocks are only just beginning. By March of this year, expect stocks to be another 10-15% lower than where they stand today, and, even then, with signs of a global slowdown flashing red, a bottom won't likely be put in until the market has flushed out all of the weak hands and sent fund managers scurrying in even greater numbers to cash and bonds.

Presently, the treasuries are telling an interesting story about the economy. While the Federal Reserve insisted on raising rates four times in 2019, the bond market has expressed extreme displeasure, sending the yield on the 10-year note to 2.56%, down ten basis points just today, marking the lowest yield since January of last year. Additionally, short-maturity bills spiked (thanks to Fed hikes at the low end) with the one-year yielding 2.50%, as compared to 2.39% for the 2-year and 2.37% for the five-year note. Inversion in accelerating at the short end of the curve.

While this is traditionally not the pairs that signal recession, that distinction belonging to the 2s-10s spread, it is highly unusual. Bond traders are saying they don't want to issue longer-term, for fear that the economy will weaken as time progresses. The 30-year also was slammed lower, yielding 2.92%, down five basis points from yesterday.

2019 is looking to be an even worse year for equity investors, and a rout in the stock market could cause panic to spread to many diverse levels of economic activity. A recession within the next three to twelve months is looking more a certainty with each passing day.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

| 1/3/19 | 22,686.22 | -660.02 | -641.24 |

At the Close, Thursday, January 3, 2019:

Dow Jones Industrial Average: 22,686.22, -660.02 (-2.83%)

NASDAQ: 6,463.50, -202.43 (-3.04%)

S&P 500: 2,447.89, -62.14 (-2.48%)

NYSE Composite: 11,190.44, -193.09 (-1.70%)

Wednesday, January 2, 2019

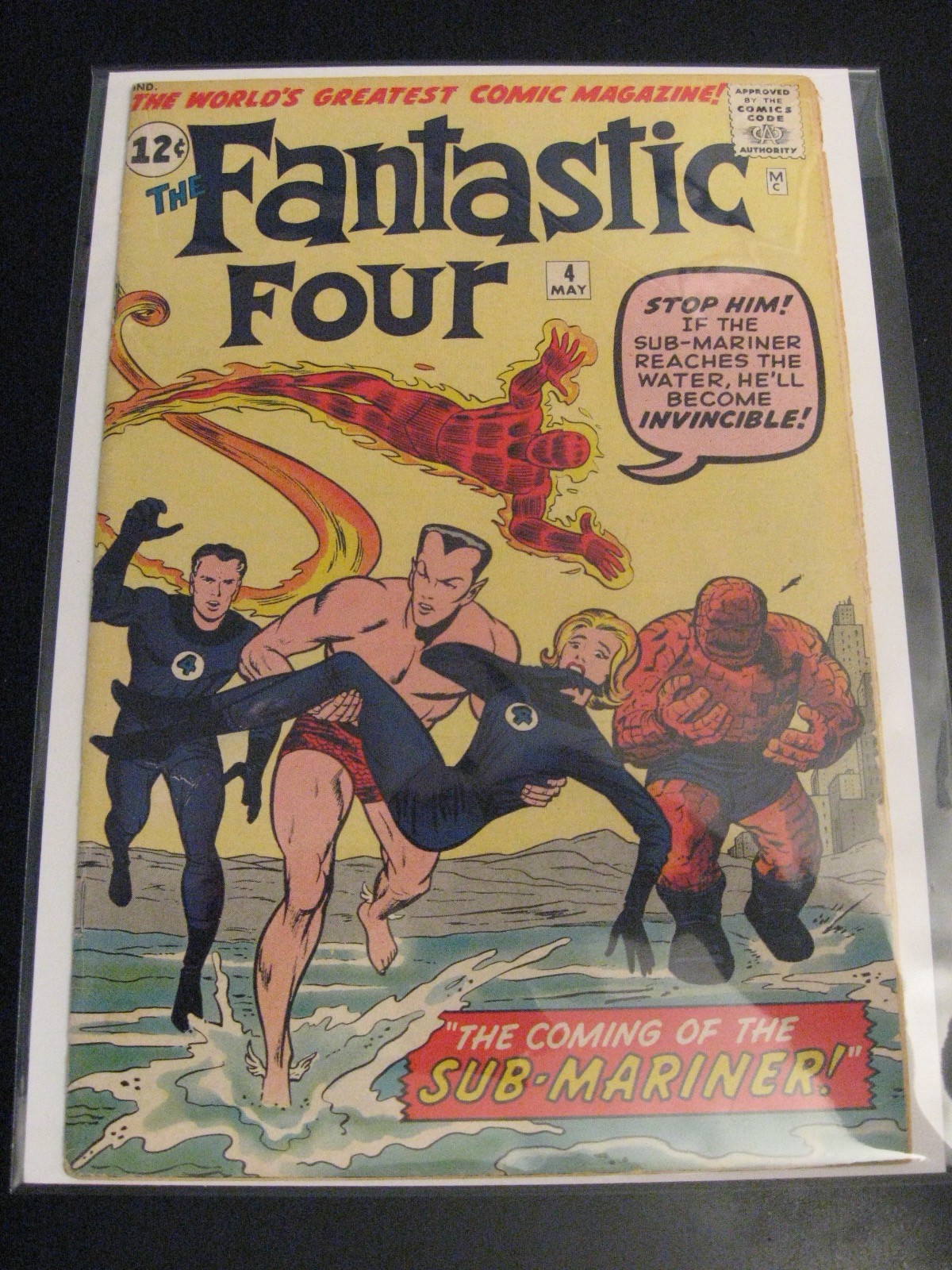

Stocks Stumble In New Year; Fantastic Four #4 12-Cent Comic Book, Now $4489

Stocks tumbled, then stumbled to an unimpressive finish on the first trading day of 2019, leaving doubt in the minds of many after the rout that was December, 2018.

What's more impressive than chasing stocks are the devotees of Marvel comics, especially the 12-cent variety from the early 60s. If you're in your 60s or older, you may remember this one from your youth. If you gave it away or trashed it, as many of us did, you might be sick to see what it's worth today.

What's more impressive than chasing stocks are the devotees of Marvel comics, especially the 12-cent variety from the early 60s. If you're in your 60s or older, you may remember this one from your youth. If you gave it away or trashed it, as many of us did, you might be sick to see what it's worth today.In a recent ebay auction, the #4 issue of Fantastic Four sold for $4,489.00, in very fine condition.

Wow! Who knew that 12 cents could turn into four grand?

Just consider, if one had saved 100 comic books from the early 60s - the ones our parents and teachers said were just a waste of time and money - and kept them in good condition, you might have a nest egg of nearly half a million dollars sitting in a box about two feet high. Ounce for ounce and pound for pound, these early comics are worth in weight more than gold.

Amazing... Spider-Man tomorrow.

Dow Jones Industrial Average January Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 1/2/19 | 23,346.24 | +18.78 | +18.78 |

At the Close, Wednesday, January 2, 2019:

Dow Jones Industrial Average: 23,346.24, +18.78 (+0.08%)

NASDAQ: 6,665.94, +30.66 (+0.46%)

S&P 500: 2,510.03, +3.18 (+0.13%)

NYSE Composite: 11,383.53, +9.14 (+0.08%)

Tuesday, January 1, 2019

The Year That Was: Investors Bid 2018 GOOD RIDDANCE; Worst Year Since 2008

Should all acquaintance be forgot and never brought to mind,

Should all acquaintance be forgot and the days of auld lang syne.

For auld lang syne, my dear, for auld lang syne,

We'll take a cup of kindness yet for the sake of auld lang syne.

Let's have a drink or maybe two or maybe three or four

Or five or six or seven or eight or maybe even more.

A cup of kindness, indeed. It's what some investors would have liked in December, or October, or maybe February or March.

Those were the worst months for stocks.

Dow loss, February, 2018: -1120.19

March, 2018: -926.09

October, 2018: -1341.55

December, 2018: -2211.10

As the year wore on, conditions proceeded to deteriorate for holders of US large cap equities. On the S&P and the NASDAQ, some stocks suffered losses of 30, 40, 50% or more.

Facebook (FB) was the poster child for tech stocks breaking bad. On July 25, the famous brainchild of Mark Zuckerberg topped out at 217.50. As of December 24, it bottomed out at a closing price of 124.06, a 43% loss. It wasn't a very merry Christmas for Facebook. Still, Zuckerberg is still one of the richest persons in the world, just not quite as rich as he used to be.

Netflix (NFLX) was another one being hammered in the second half of the year. Closing at 418.97 on July 9, the streaming video service lost 44% by December 24, closing that session at 233.88.

Stocks weren't the only asset class that was sucker-punched during the year. One standout of the commodities class was crude oil, where the price of a barrel of West Texas Intermediate (WTI) shot up from $60 to $76 in October - coincidentally, on the same day the Dow peaked - before retreating to under $45 nearing the end of December, striking a low of $42.53 on Christmas Day.

In similar manner, precious metals were abused during the year. Gold spent the early part of the year fluctuating in the $1300-1350 per ounce range, never closing above $1352. By June, signs of weakness were appearing, with the metal of kings dipping into the $1200 range, eventually bottoming out at $1178 by August. With stocks on the decline in the fourth quarter, gold was the beneficiary, ending the year at $1278 per ounce.

Silver was damaged more severely. Peaking at $17.52 per ounce on January 25, silver slumped all the way to 13.97 in November. December was the best month of the year for gentleman's coin, as it closed at a five-month high on December 31, with a price of $15.46. Both gold and silver ended the year on high notes, suggesting that they are due for a long-overdue rally.

Bonds were perhaps the most entertaining of the financial assets, with investors watching for an inversion in the treasury yield curve between the two and 10-year notes. While that did not materialize, a smaller inversion between 2 and three-year and the five-year yield presented itself in December, but only persisted for three weeks. The five-year was actually yielding less than both the 2s and 3s on December 4, but corrected back to normalcy - with yields rising over duration - on December 21. Still, it was a wake-up call to investors fearing a recession in 2019 and may have contributed to some of the panic selling during the final month of 2018.

Yield on the barometric 10-year note ended the year at an 11-month low, checking in at 2.69% on New Year's Eve. The 30-year was also pushed lower. By year's end, it was yielding a mere 3.02%, all of this occurring in the face of four quarterly federal funds rate hikes over the course of the annum. Surely, the bond vigilantes are out in force, and as the year of 2018 comes to a close, fear is winning out over greed in rather obvious manner.

What 2019 will bring is anyone's guess, considering the continuing dysfunction coming out of the nation's capitol. Republicans and Democrats are at war, leaving the American people to fend as best they can as casualties or collaterally-damaged bystanders. Rhetoric from both sides of the aisle has been inflamed to a combustible state, and, with the partial government shutdown already in its second week, when the Democrats seize control of the House of Representatives on January 3, chaos will reign.

Despite honest effort from President Trump, nothing good will come out of Washington this year, unless one considers complete rejection of government by the people to be constructive, because that is precisely where the swamp dwellers inside the beltway - with ample assistance from a media that operates as a free press in name only - are taking the country.

2019 may be a year worse than the one preceding it, perhaps much worse, as the political leaders of the greatest nation on the planet can do no better than bicker, posture, and fail in their duties.

Until and unless Washington changes its ways, the financial picture will be clouded by the politicians, whose only aim seems to be one of destroying anything good in the country. While the Democrats can largely be blamed for inciting division, Republicans in the Senate share nearly equal responsibility for not standing up for the public.

Sadly, Washington has made it clear that it wants to be all-important, all the time. The cost will be borne by the people in ways that exceed mere finance.

Dow Jones Industrial Average December Scorecard:

| Date | Close | Gain/Loss | Cum. G/L |

| 12/3/18 | 25,826.43 | +287.97 | +287.97 |

| 12/4/18 | 25,027.07 | -799.36 | -511.39 |

| 12/6/18 | 24,947.67 | -79.40 | -590.79 |

| 12/7/18 | 24,388.95 | -558.72 | -1149.51 |

| 12/10/18 | 24,423.26 | +34.31 | -1115.20 |

| 12/11/18 | 24,370.24 | -53.02 | -1168.22 |

| 12/12/18 | 24,527.27 | +157.03 | -1011.19 |

| 12/13/18 | 24,597.38 | +70.11 | -941.08 |

| 12/14/18 | 24,100.51 | -496.87 | -1437.95 |

| 12/17/18 | 23,592.98 | -507.53 | -1945.58 |

| 12/18/18 | 23,675.64 | +82.66 | -1862.92 |

| 12/19/18 | 23,323.66 | -351.98 | -2214.90 |

| 12/20/18 | 22,859.60 | -464.06 | -2678.96 |

| 12/21/18 | 22,445.37 | -414.23 | -3093.19 |

| 12/24/18 | 21,792.20 | -653.17 | -3746.36 |

| 12/26/18 | 22,878.45 | +1086.25 | -2660.11 |

| 12/27/18 | 22,878.45 | +260.37 | -2399.74 |

| 12/28/18 | 23,062.40 | -76.42 | -2476.16 |

| 12/31/18 | 23,327.46 | +265.06 | -2211.10 |

At the Close, Monday, December 31, 2019:

Dow Jones Industrial Average: 23,327.46, +265.06 (+1.15%)

NASDAQ: 6,635.28, +50.76 (+0.77%)

S&P 500: 2,506.85, +21.11 (+0.85%)

NYSE Composite: 11,374.39, +83.44 (+0.74%)

Labels:

10-year note,

congress,

crude oil,

Democrats,

Facebook,

FB,

gold,

Mark Zuckerberg,

Netflix,

NFLX,

Republicans,

silver,

tech,

WTI crude

Subscribe to:

Comments (Atom)