Sunday, October 5, 2025, 11:34 am ET

The federal government's game of musical chairs, combined with finger-pointing, grandstanding, and bluffing, will be a week old by Tuesday, but that's still probably too soon for financial markets to begin pondering outcomes. For now, life in the U.S.A. continues on without a hitch. President Trump has been calling in some markers, withholding funds from states, especially those earmarked for green energy projects, the most prominent being New York, which pledged to its "woke" constituency back when Andrew Cuomo was still governor, that it would be fully "green" by 2030.

The federal government's game of musical chairs, combined with finger-pointing, grandstanding, and bluffing, will be a week old by Tuesday, but that's still probably too soon for financial markets to begin pondering outcomes. For now, life in the U.S.A. continues on without a hitch. President Trump has been calling in some markers, withholding funds from states, especially those earmarked for green energy projects, the most prominent being New York, which pledged to its "woke" constituency back when Andrew Cuomo was still governor, that it would be fully "green" by 2030.

Like all other government promises and projections, that one is likely to never come to fruition, but that's a discussion for another day. Presently, there isn't much that would indicate that anything has gone awry. It's probably going to take a statement from Treasury Secretary Bessent for anybody to notice the cracks widening in the economy because many of the usual benchmark data releases are not going to happen while various agencies are on furlough.

In essence, markets are flying blind, keeping up hopes that the political hacks in D.C. will come to their senses and make a deal - even if it's only good for six weeks - to fund their operations. That sentiment is not going to last much beyond a few more weeks if the shutdown persists. While stocks continued to make new highs, there has been some leakage of money flows into fixed income, and, more importantly, to gold, silver, and bitcoin.

Stocks

The NASDAQ's 230-point drop from the high to the low on Friday may have been a warning shot fired. Similarly, the S&P shedding 45 points before finishing up less than 0.02% for the day, served notice that conditions are worsening, or, to put it in more mundane parlance, "things are getting a bit dicey."

Stocks took the government shutdown with the usual whistle past the graveyard. The rally off the April tariff lows remains in place, but the failure of the Dow Transports to confirm the move to record highs on the Industrials has Dow Theorists losing some sleep, not that anybody has time nor patience for fundamental analysis anymore.

One of the variants of the government shutdown was that the BLS wasn't around to fool everybody with phony employment numbers from September. In stepped ADP on Wednesday, announcing that the private sector lost 32,000 jobs over the month and August was revised down by 43,000. Adding in the 600-750,000 government employees taking time off via the shutdown, the number of job losses since the end of July is closing in on a million, and that's not including the government contractors who will be putting some - if not all - workers on leave shortly.

The longer the government keeps the "out of order" signs posted, the worse the already weak employment sector of the economy is going to become. That's usually something Wall Street can redefine as a positive because when private companies do it, it lowers expenses and boosts the bottom line. This time may be different, though it's to be expected that the Big Kahunas of finance won't come right out and say so.

The week ahead, outside of the shutdown dynamics, offers the first glimpses of third quarter earnings from a number of key companies. The week following will see earnings season kick into high gear, starting with the banks, but let's not get too far ahead of the game. Here are some items of interest looking forward:

Monday, October 6: Constellation Brands (STZ) reports, OpenAI's DevDay developer conference kicks off.

Tuesday, October 7: McCormick (MKC) reports 3Q earnings. Consumer credit (August), Federal Reserve's Atlanta President Raphael Bostic, Vice Chair Michelle Bowman, Governor Stephen Miran and Minneapolis FedRes President Neel Kashkari all have speaking engagements. Amazon's (AMZN) Prime Big Deal Days Begin. U.S. August trade deficit delayed, not reporting.

Wednesday, October 8: Bassett Furniture (BSET) reports 3Q earnings; FOMC Minutes from September meeting; Fed Officials, including Fed Governor Michael Barr, St. Louis Fed President Alberto Musalem speak.

Thursday, October 9: PepsiCo (PEP), Delta Air Lines (DAL), Levi Strauss (LEVI), Applied Digital (APLD), Helen of Troy (HELE) report 3Q earnings. Initial jobless claims (Week ending 10/4), Wholesale Inventories for August will not be reported. Fed Chairman Jerome Powell, Treasury Secretary Scott Bessent, and Fed Vice Chair for Supervision Michelle Bowman are all expected to speak at Fed’s Community Bank Conference.

Friday, October 10: University of Michigan Consumer sentiment for October will be reported; Monthly U.S. federal budget for September may not be (still in doubt). Chicago Fed President Austan Goolsbee, St. Louis Fed President Alberto Musalem have speaking engagements.

The Shiller PE (CAPE) closed out the week at 40.08, a 25 year high (since the dotcom bubble)

Treasury Yield Curve Rates

| Date | 1 Mo | 1.5 mo | 2 Mo | 3 Mo | 4 Mo | 6 Mo | 1 Yr |

| 08/29/2025 | 4.41 | 4.34 | 4.30 | 4.23 | 4.17 | 4.01 | 3.83 |

| 09/05/2025 | 4.29 | 4.24 | 4.24 | 4.07 | 4.05 | 3.85 | 3.65 |

| 09/12/2025 | 4.24 | 4.24 | 4.20 | 4.08 | 4.02 | 3.83 | 3.66 |

| 09/19/2025 | 4.19 | 4.16 | 4.14 | 4.03 | 3.98 | 3.81 | 3.60 |

| 09/26/2025 | 4.22 | 4.20 | 4.17 | 4.02 | 4.00 | 3.83 | 3.67 |

| 10/03/2025 | 4.24 | 4.17 | 4.11 | 4.03 | 3.96 | 3.82 | 3.64 |

| Date | 2 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | 20 Yr | 30 Yr |

| 08/29/2025 | 3.59 | 3.58 | 3.68 | 3.92 | 4.23 | 4.86 | 4.92 |

| 09/05/2025 | 3.51 | 3.48 | 3.59 | 3.80 | 4.10 | 4.72 | 4.78 |

| 09/12/2025 | 3.56 | 3.52 | 3.63 | 3.81 | 4.06 | 4.65 | 4.68 |

| 09/19/2025 | 3.57 | 3.56 | 3.68 | 3.88 | 4.14 | 4.71 | 4.75 |

| 09/26/2025 | 3.63 | 3.66 | 3.76 | 3.96 | 4.20 | 4.74 | 4.77 |

| 10/03/2025 | 3.58 | 3.59 | 3.72 | 3.90 | 4.13 | 4.69 | 4.71 |

Yields on notes and bonds fell this week, with the bulk of the moves happening Monday, as the market correctly sensed the government shutdown and fled risk assets for the safety of treasuries. Of course, the moves in bonds were dwarfed by those in the gold and silver markets, which are becoming increasingly explosive.

There's some irony here, as treasury notes and bonds, being government obligations, saw buying just as the government itself begins to run out of funding. The longer the government remains in "partial shutdown" mode, the riskier these obligations become, bringing into play the ages-old dilemma of promises for return ON one's money becoming a question of return OF one's money. Sooner or later - and the odds seem to favor sooner - a major Western government is going to formally default and $$ trillions will be lost in a matter of hours or days. Once that genie leaves the bottle, there will be no turning back and the fiat currency regime that has now reached an advanced age of 54 years (1971-2025) will embark upon the final collapse.

In the meantime, whichever government is in control in the United States or The United States, still appears to be capable of compromise, to end the shutdown and get back to the business of wheedling away at the wealth of the nation. It's beginning to look like this is going to drag on a few more weeks at least, and that the drama hasn't really yet begun.

Spreads were compressed over the week, with full spectrum down from +55 to +47, and 2s-10s retreating 12 basis points, from +57 to +45, tying for the lowest since the tariff tantrum in April of this year. If spreads continue to decline, banks will no longer have healthy lending margins, which always leads to a liquidity crisis.

A lot has been said recently about "Curve Control" policies being implemented by the Fed in order to maintain market stability. That would invlove more purchases at treasuries at lower yields, which would go straight to its balance sheet, which has been reduced from nearly $9 trillion down to near $6.5 trillion over the past three years. If the Fed has to begin making more purchases - and bear in mind that they're technically bankrupt already - they will be doing so with "magic money" created out of thin air, something of which global markets have had a belly full in recent years.

Spreads:

2s-10s

9/15/2023: -69

9/22/2023: -66

9/29/2023: -44

10/06/2023: -30

10/13/2023: -41

10/20/2023: -14

10/27/2023: -15

11/03/2023: -26

11/10/2023: -43

11/17/2023: -44

11/24/2023: -45

12/01/2023: -34

12/08/2023: -48

12/15/2023: -53

12/22/2023: -41

12/29/2023: -35

1/5/2024: -35

1/12/2024: -18

1/19/2024: -24

1/26/2024: -19

2/2/2024: -33

2/9: -31

2/16: -34

2/23: -41

3/1: -35

3/8: -39

3/15: -41

3/22: -37

3/28: -39

4/5: -34

4/12: -38

4/19: -35

4/26: -29

5/3: -31

5/10: -37

5/17: -39

5/24: -47

5/31: -38

6/7: -44

6/14: -47

6/21: -45

6/28: -35

7/5: -32

7/12: -27

7/19: -24

7/26: -16

8/2: -08

8/9: -11

8/16: -17

8/23: -09

8/30: 00

9/6: +06

9/13: +09

9/20: +18

9/27: +20

10/4: +5

10/11: +13

10/18: +13

10/25: +14

11/1: +16

11/8: +5

11/15: +12

11/22: +4

11/29: +5

12/6: +5

12/13: +15

12/20: +22

12/27: +31

1/3: +32

1/10: +37

1/17: +34

1/24: +36

1/31: +36

2/7: +20

2/14: +21

2/21: +23

2/28: +25

3/7: +33

3/14: +29

3/21: +31

3/28: +38

4/4: +33

4/11: +52

4/17: +53

4/25: +55

5/2: +50

5/9: +49

5/16: +45

5/23: +51

5/30: +52

6/6: +48

6/13: +45

6/20: +48

6/27: +56

7/3: +47

7/11: +53

7/18: +56

7/25: +49

8/1: +54

8/8: +51

8/15: +58

8/22: +58

8/29: +64

9/5: +59

9/12: +50

9/19: +57

9/26: +57

Full Spectrum (30-days - 30-years)

9/15/2023: -109

9/22/2023: -99

9/29/2023: -82

10/06/2023: -64

10/13/2023: -82

10/20/2023: -47

10/27/2023: -54

11/03/2023: -76

11/10/2023: -80

11/17/2023: -93

11/24/2023: -95

12/01/2023: -105

12/08/2023: -123

12/15/2023: -154

12/22/2023: -149

12/29/2023: -157

1/5/2024: -133

1/12/2024: -135

1/19/2024: -118

1/26/2024: -116

2/2/2024: -127

2/9: -117

2/16: -103

2/23: -112

3/1: -121

3/8: -125

3/15: -109

3/22: -112

3/28: -115

4/5: -93

4/12: -87

4/19: -77

4/26: -70

5/3: -85

5/10: -87

5/17: -94

5/24: -99

5/31: -83

6/7: -92

6/14: -113

6/21: -103

6/28: -96

7/5: -101

7/12: -108

7/19: -103

7/26: -104

8/2: -143

8/9: -131

8/16: -138

8/23: -141

8/30: -121

9/6: -125

9/13: -117

9/20: -80

9/27: -80

10/4: -75

10/11: -58

10/18: -54

10/25: -38

11/1: -18

11/8: -23

11/15: -10

11/22: -12

11/29: -40

12/6: -23

12/13: +18

12/20: +29

12/27: +38

1/3: +38

1/10: +54

1/17: +41

1/24: +40

1/31: +36

2/7: +32

2/14: +32

2/21: +31

2/28: +13

3/7: +24

3/14: +25

3/21: +23

3/28: +26

4/4: +5

4/11: +38

4/17: +44

4/25: +40

5/2: +41

5/9: +46

5/16: +52

5/23: +68

5/30: +59

6/6: +69

6/13: +67

6/20: +69

6/27: +66

7/3: +51

7/11: +59

7/18: +65

7/25: +55

8/1: +32

8/8: +37

8/15: +44

8/22: +41

8/29: +51

9/5: +49

9/12: +40

9/19: +54

9/26: +55

Oil/Gas

WTI crude oil closed out the week at $60.36, down sharply from the close on 9/26 at $65.19. While the decline was "unexpected" to some people in the business of tracking oil prices, it was no surprise to those following technical analysis. Oil, from Brent to WTI to Russian oil sold to India, China, and elsewhere, remains in a long term bear market, dating back to June 2022, when it peaked at $118/barrel, and more recently, in September, 2023, reaching a peak of $90.79. Simple math says WTI crude is down a third from two years ago with no end to the price decline or a bottoming evidenced anywhere.

The lower price for crude oil, running counter-cyclical to inflation, may be indicating something deeper and darker than the otherwise bubbling stock market is telling. The suggestion is that the global economy - which, despite protestations from climate change true believers, still runs on coal, oli, and natural gas - has been slowing for the better part of two years. There's evidence in Europe, to be sure, though one wouldn't see the same structure. European oil prices have been rising steadily and only recently stabilized, since the outbreak of the conflict in Ukraine in February, 2022.

European economies in the largest countries - Germany France, Italy, England - are on the brink of economic collapse. Energy prices in those countries have nowhere to go but lower, as people essentially go broke just trying to fund everyday needs. While lower prices for crude oil and petrol may offer some relief, it's on the back of a manufacturing slowdown of depression-era proportions.

U.S. gas prices were moderately higher over the course of the week, the national average at $3.12 Sunday morning, according to Gasbuddy.com.

State-by-state numbers show California remaining on top, steady at $4.65 per gallon, followed by Washington ($4.51), which was six cents lower and joined in the $4 club by Oregon ($4.12), also down. The lowest prices remain in the Southeast, with Oklahoma ($2.55) ranging in a multi-month low, followed by Mississippi ($2.66), Louisiana ($2.70) and Arkansas.

The Northeast remained, as a bloc, above $3.00, though Delaware ($2.96) and New Hampshire ($2.98), breaking below. Virginia ($2.97), West Virginia ($2.94), and Kentucky ($2.81) remained lower, though Ohio surged slightly to $3.00. Indiana ($3.01), Michigan ($3.08), and Illinois ($3.30) are the only midwest states above $3. All midewest states from Wisconsin, Minnesota, and North Dakota south to Missouri, Kansas, and Colorado are below $3/gallon.

Sub-$3.00 gas can be found in 26 states, up one from last week, concentrated in the South and Midwest with Ohio and Florida back above the line, but Wyoming, New Hampshire and Delaware dropping below. The entire Southeast, out to New Mexico ($2.88) is under $3.00 a gallon. Gas in next door neighbor New Mexico is $3.54, making border hops appealing to cost-conscious drivers, though the gap has narrowed by 11 cents from last week.

Bitcoin

Early Sunday morning, bitcoin reached a new all-time high of $125,178.70. It has backed off some $2000+ dollars since.

This week: $122,985.87

Last week: $109,980.20

2 weeks ago: $115,734.60

6 months ago: $83,366.77

One year ago: $62,619.78

Five years ago: $11,295.51

Money will flow to bitcoin if there's some trouble in stocks. However, should there be margin calls on a severe market break, bitcoin will be one of the first assets sold, ahead of gold and silver, which are more likely, this time around, to be held onto by speculators and anybody with functioning brains.

Precious Metals

Gold:Silver Ratio: 81.55; last week: 81.73

Per COMEX continuous contracts:

Gold price 9/5: $3,639.80

Gold price 9/12: $3,680.70

Gold price 9/19: $3,719.40

Gold price 9/26: $3,789.80

Gold price 10/3: $3,912.10

Silver price 9/5: $41.51

Silver price 9/12: $42.68

Silver price 9/19: $43.37

Silver price 9/26: $46.37

Silver price 10/3: $47.97

Money Daily's weekly survey on eBay and a quick price hunt on a number of online dealers revealed that silver cannot be purchased, except in large quantities or under unusual circumstances, for less than $50 per ounce, nor can gold be had under $4,000. The confluence of events, including a shortage in silver bullion, the government shutdown, recent and ongoing efforts by China, via the Shanghai Metals Exchange and vaulting facilities being readied in Hong Kong, Dubai and elsewhere, have turned the tables on the London price fixes, LBMA, and COMEX operations. Increasingly, gold, silver, platinum, and palladium price are being set elsewhere, reflecting a fundamental shift in global economies. Silver, especially, has been making record highs in just about every country except for the United States, which continues to maintain short positions, costing billions of dollars. Eventually, the U.S. is going to have to stop their foolish suppression games or pay severe consequences.

Prices continue to rise, and now that investment advisors are recommending 15-25% allocation to precious metals to their high net worth clients, prices will, almost without a doubt, skyrocket. There have been no pullbacks and nothing short of a major war or stock market crash can cause any. Even then, gold and silver might actually explode even higher as safe-haven assets. Those who have been patiently stacking and hoarding are soon to experience great financial rewards.

Here are the most recent prices for common one ounce gold and silver items sold on eBay (free shipping included, numismatics excluded):

| Item/Price | Low | High | Average | Median |

| 1 oz silver coin: | 49.95 | 59.00 | 53.40 | 52.38 |

| 1 oz silver bar: | 49.95 | 58.00 | 53.48 | 54.27 |

| 1 oz gold coin: | 3,985.51 | 4,166.61 | 4,067.79 | 4,071.24 |

| 1 oz gold bar: | 3,959.99 | 4,101.60 | 4,055.58 | 4,065.08 |

The Single Ounce Silver Market Price Benchmark (SOSMPB) made another new record high since Money Daily began recording in 2020, of $53.38, a healthy gain of $1.34 from the September 28 price of $52.04 per troy ounce.

Gold and silver continued to move higher, with silver leading the way over the near term. Year-to-date, gold is up 48.01%; silver, 64.06%, both up six weeks running as of Friday closes on the COMEX.

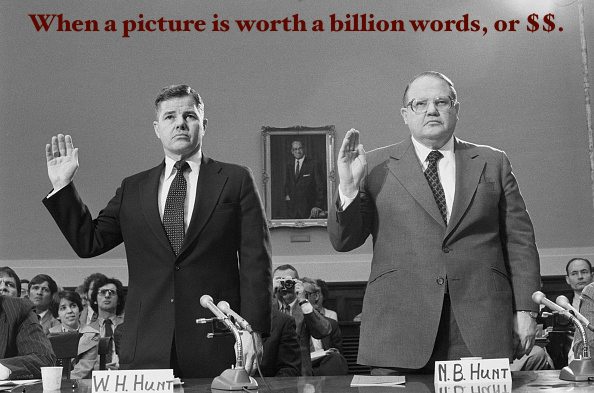

Speaking of the COMEX, silver is currently, and has been for a few weeks, in backwardation, a condition where the spot price is higher than the futures price. It was reported on Saturday that there is not a single out of silver available to short on the market, a condition, for all intents and purposes, has never occurred before. Additionally, the criminals at the COMEX raised margin requirements for all gold and silver contracts, but apparently not enough to slow down price gains. The CME and COMEX may have to resort to tactics last deployed in early 1980, as a response to the attempt by brothers Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt (collectively known as the Hunt Brothers) to corner the silver market.

As the story goes, on January 7, 1980, the COMEX board of governors announced that it would cap the size of silver futures exposure to 3 million ounces. Those in excess of the cap (Bunker was long on 45 million ounces; Herbert held contracts for 20 million) were given until the following month to bring themselves into compliance. That was too long a wait for the Chicago Board of Trade exchange, which suspended the issue of any new silver futures on January 21. Silver futures traders would only be allowed to square up old contracts. Silver contracts were "sell only."The price of silver falling at an accelerated pace, the Hunt's were issued margin calls. The Bache Group wanted $100 more in collateral for the money they had lent the Hunts. On March 27, 1980, which has become known as "Silver Thursday", the price of silver fell to $10.80 per ounce, off a high of $50.42 in January. The Hunt Brothers were all but wiped out, reportedly losing over a billion dollars in one day, prompting Bunker to famously say, "a billion dollars ain't what it used to be."

WEEKEND WRAP

When everything blows up again, because it always does and this bubble bursting should be spectacular, maybe somebody like Elon Musk, Jeff Bezos, Bill Gates or Mark Zuckerberg will say, "a trillion dollars isn't what it used to be," an object lesson for us all, proceeding through the age of delusion.

At the Close, Friday, October 3, 2025:

Dow: 46,758.28, +238.56 (+0.51%)

NASDAQ: 22,780.51, -63.54 (-0.28%)

S&P 500: 6,715.79, +0.44 (+0.01%)

NYSE Composite: 21,725.40, +117.43 (+0.54%)

For the Week:

Dow: +510.99 (+1.10%)

NASDAQ: +296.44 (+1.32%)

S&P 500: +72.09 (+1.09%)

NYSE Composite: +247.89 (+1.15%)

Dow Transports: +110.09 (+0.70%)

Disclaimer: Information disseminated on this site should not be construed as investment advice. Downtown Magazine Inc., Money Daily and it's owners, affiliates and/or employees are not investment advisors and do not offer specific investment advice. All investments have risk. You should consult a professional investment advisor or stock broker or use your individual judgement when making investment decisions. By viewing this site, you hold harmless Downtown Magazine Inc., Money Daily, its owners, affiliates and employees against any and all liability. Copyright 2025, Downtown Magazine Inc., all rights reserved.

No comments:

Post a Comment