Should all acquaintance be forgot and never brought to mind,

Should all acquaintance be forgot and the days of auld lang syne.

For auld lang syne, my dear, for auld lang syne,

We'll take a cup of kindness yet for the sake of auld lang syne.

Let's have a drink or maybe two or maybe three or four

Or five or six or seven or eight or maybe even more.

A cup of kindness, indeed. It's what some investors would have liked in December, or October, or maybe February or March.

Those were the worst months for stocks.

Dow loss, February, 2018: -1120.19

March, 2018: -926.09

October, 2018: -1341.55

December, 2018: -2211.10

As the year wore on, conditions proceeded to deteriorate for holders of US large cap equities. On the S&P and the NASDAQ, some stocks suffered losses of 30, 40, 50% or more.

Facebook (FB) was the poster child for tech stocks breaking bad. On July 25, the famous brainchild of Mark Zuckerberg topped out at 217.50. As of December 24, it bottomed out at a closing price of 124.06, a 43% loss. It wasn't a very merry Christmas for Facebook. Still, Zuckerberg is still one of the richest persons in the world, just not quite as rich as he used to be.

Netflix (NFLX) was another one being hammered in the second half of the year. Closing at 418.97 on July 9, the streaming video service lost 44% by December 24, closing that session at 233.88.

Stocks weren't the only asset class that was sucker-punched during the year. One standout of the commodities class was crude oil, where the price of a barrel of West Texas Intermediate (WTI) shot up from $60 to $76 in October - coincidentally, on the same day the Dow peaked - before

retreating to under $45 nearing the end of December, striking a low of $42.53 on Christmas Day.

In similar manner, precious metals were abused during the year. Gold spent the early part of the year fluctuating in the $1300-1350 per ounce range, never closing above $1352. By June, signs of weakness were appearing, with the metal of kings dipping into the $1200 range, eventually bottoming out at $1178 by August. With stocks on the decline in the fourth quarter, gold was the beneficiary, ending the year at $1278 per ounce.

Silver was damaged more severely. Peaking at $17.52 per ounce on January 25, silver slumped all the way to 13.97 in November. December was the best month of the year for gentleman's coin, as it closed at a five-month high on December 31, with a price of $15.46. Both gold and silver ended the year on high notes, suggesting that they are due for a long-overdue rally.

Bonds were perhaps the most entertaining of the financial assets, with investors watching for an inversion in the treasury yield curve between the two and 10-year notes. While that did not materialize, a smaller inversion between 2 and three-year and the five-year yield presented itself in December, but only persisted for three weeks. The five-year was actually yielding less than both the 2s and 3s on December 4, but corrected back to normalcy - with yields rising over duration - on December 21. Still, it was a wake-up call to investors fearing a recession in 2019 and may have contributed to some of the panic selling during the final month of 2018.

Yield on the barometric 10-year note ended the year at an 11-month low, checking in at 2.69% on New Year's Eve. The 30-year was also pushed lower. By year's end, it was yielding a mere 3.02%, all of this occurring in the face of four quarterly federal funds rate hikes over the course of the annum. Surely, the bond vigilantes are out in force, and as the year of 2018 comes to a close, fear is winning out over greed in rather obvious manner.

What 2019 will bring is anyone's guess, considering the continuing dysfunction coming out of the nation's capitol. Republicans and Democrats are at war, leaving the American people to fend as best they can as casualties or collaterally-damaged bystanders. Rhetoric from both sides of the aisle has been inflamed to a combustible state, and, with the partial government shutdown already in its second week, when the Democrats seize control of the House of Representatives on January 3, chaos will reign.

Despite honest effort from President Trump, nothing good will come out of Washington this year, unless one considers

complete rejection of government by the people to be constructive, because that is precisely where the swamp dwellers inside the beltway - with ample assistance from a media that operates as a free press in name only - are taking the country.

2019 may be a year worse than the one preceding it, perhaps much worse, as the political leaders of the greatest nation on the planet can do no better than bicker, posture, and fail in their duties.

Until and unless Washington changes its ways, the financial picture will be clouded by the politicians, whose only aim seems to be one of destroying anything good in the country. While the Democrats can largely be blamed for inciting division, Republicans in the Senate share nearly equal responsibility for not standing up for the public.

Sadly, Washington has made it clear that it wants to be all-important, all the time. The cost will be borne by the people in ways that exceed mere finance.

Dow Jones Industrial Average December Scorecard:

| Date |

Close |

Gain/Loss |

Cum. G/L |

| 12/3/18 |

25,826.43 |

+287.97 |

+287.97 |

| 12/4/18 |

25,027.07 |

-799.36 |

-511.39 |

| 12/6/18 |

24,947.67 |

-79.40 |

-590.79 |

| 12/7/18 |

24,388.95 |

-558.72 |

-1149.51 |

| 12/10/18 |

24,423.26 |

+34.31 |

-1115.20 |

| 12/11/18 |

24,370.24 |

-53.02 |

-1168.22 |

| 12/12/18 |

24,527.27 |

+157.03 |

-1011.19 |

| 12/13/18 |

24,597.38 |

+70.11 |

-941.08 |

| 12/14/18 |

24,100.51 |

-496.87 |

-1437.95 |

| 12/17/18 |

23,592.98 |

-507.53 |

-1945.58 |

| 12/18/18 |

23,675.64 |

+82.66 |

-1862.92 |

| 12/19/18 |

23,323.66 |

-351.98 |

-2214.90 |

| 12/20/18 |

22,859.60 |

-464.06 |

-2678.96 |

| 12/21/18 |

22,445.37 |

-414.23 |

-3093.19 |

| 12/24/18 |

21,792.20 |

-653.17 |

-3746.36 |

| 12/26/18 |

22,878.45 |

+1086.25 |

-2660.11 |

| 12/27/18 |

22,878.45 |

+260.37 |

-2399.74 |

| 12/28/18 |

23,062.40 |

-76.42 |

-2476.16 |

| 12/31/18 |

23,327.46 |

+265.06 |

-2211.10 |

At the Close, Monday, December 31, 2019:

Dow Jones Industrial Average: 23,327.46, +265.06 (+1.15%)

NASDAQ: 6,635.28, +50.76 (+0.77%)

S&P 500: 2,506.85, +21.11 (+0.85%)

NYSE Composite: 11,374.39, +83.44 (+0.74%)

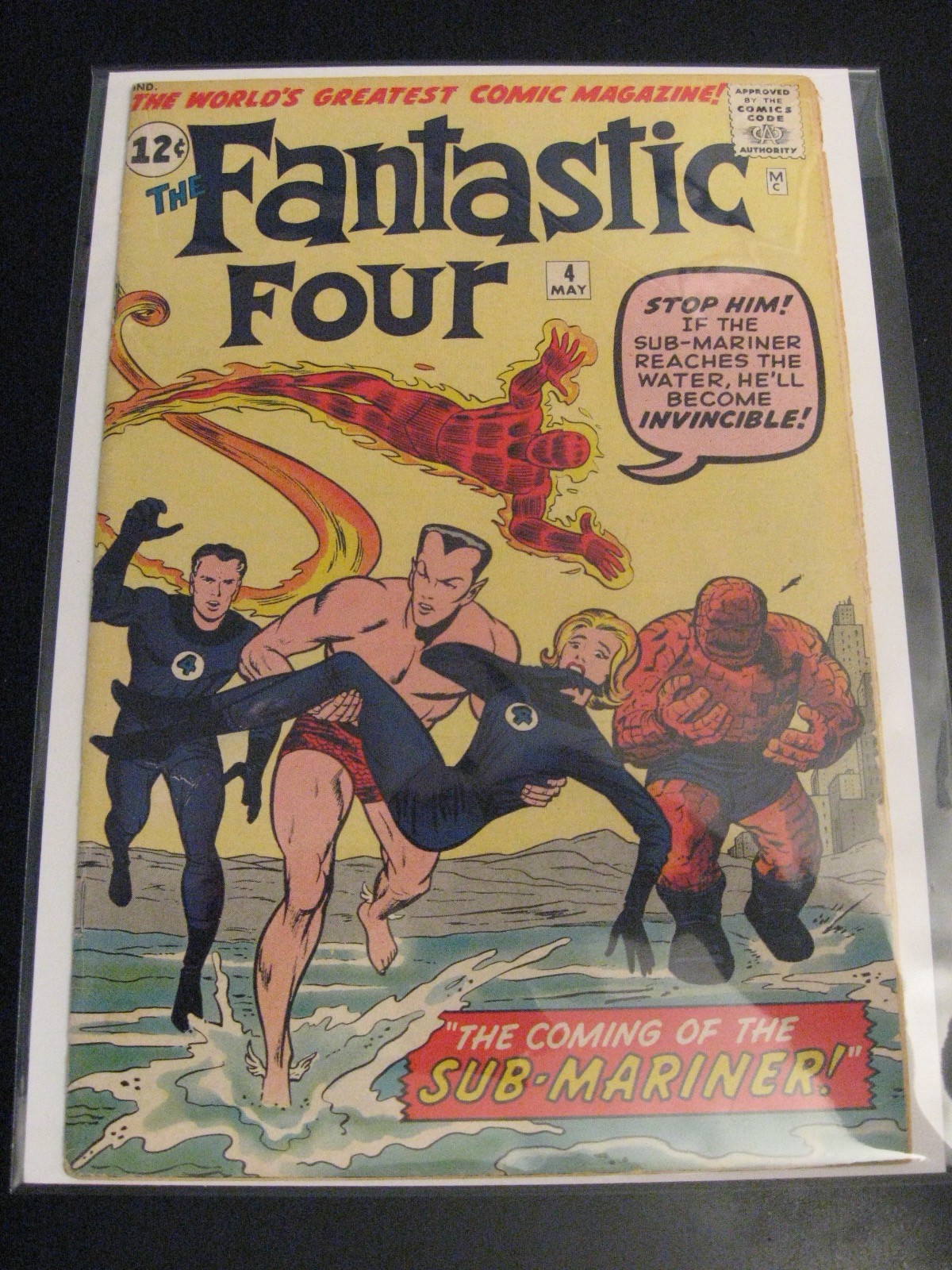

What's more impressive than chasing stocks are the devotees of Marvel comics, especially the 12-cent variety from the early 60s. If you're in your 60s or older, you may remember this one from your youth. If you gave it away or trashed it, as many of us did, you might be sick to see what it's worth today.

What's more impressive than chasing stocks are the devotees of Marvel comics, especially the 12-cent variety from the early 60s. If you're in your 60s or older, you may remember this one from your youth. If you gave it away or trashed it, as many of us did, you might be sick to see what it's worth today.