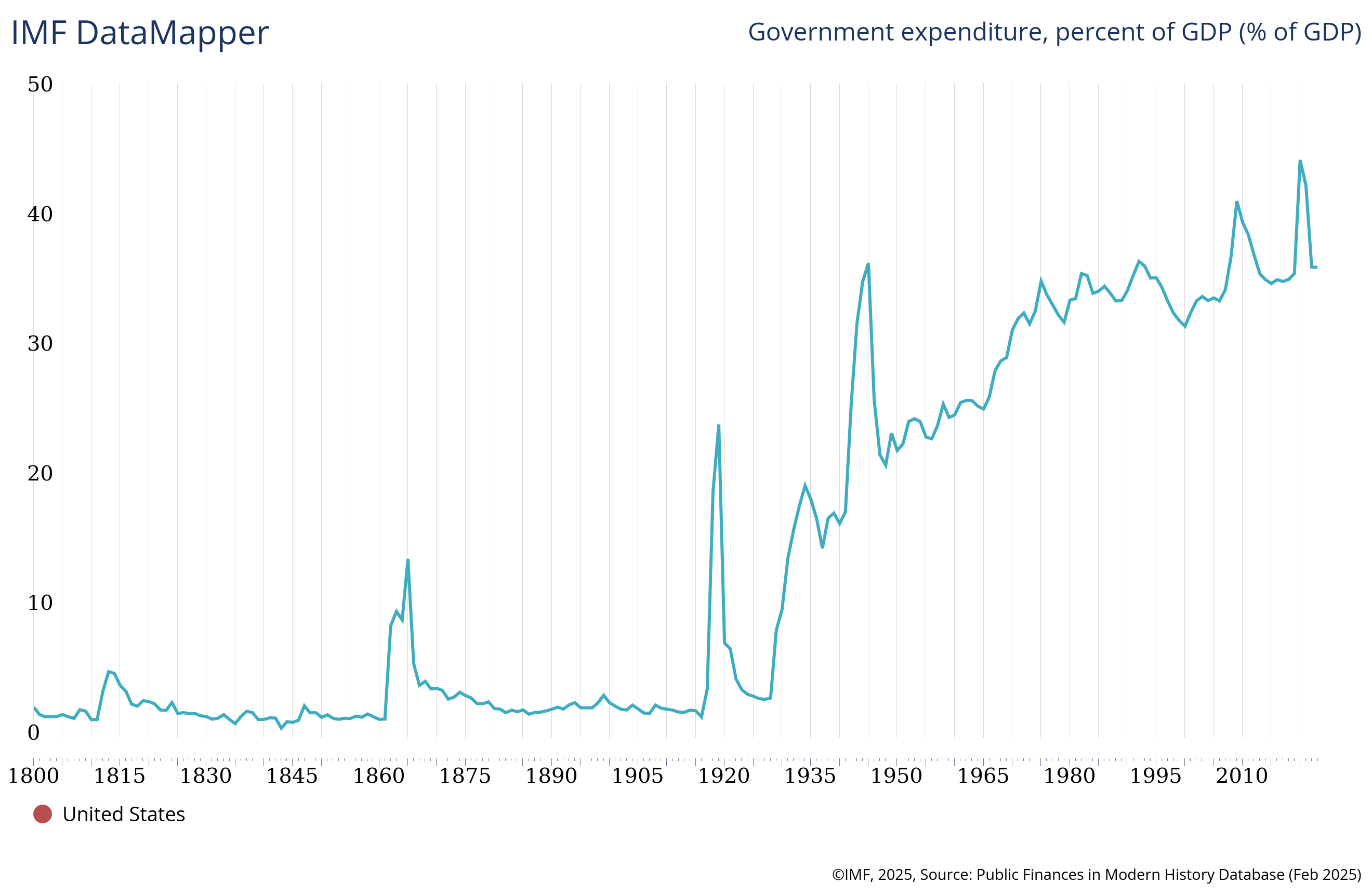

Right off the bat, one needs to deduct at least 30% of total GDP from whatever figure one is using because that is the percentage of GDP that is government spending, which produces nothing and accounts for $200 toilet seats, $57 screwdrivers and other absurd excesses.

The chart below, from the IMF, shows how government's contribution to GDP has grown over the years, from about two percent before the 1930s Great Depression to well above 30% since around 1970. So, GDP, being vastly overstated, is a complete canard, and a horrible measure of a nation's productivity.

One would have to reach back and re-jigger all the data, stripping out government expenditures, from the 1920s forward, to even get anything that somewhat resembles a true picture of the U.S. economy. With the government's greedy hands in everything from lemonade stands to B-2 bombers, it's hard to imagine any economy - much less that of the bloated U.S. - that doesn't include purchases by the government to boost its attractiveness to worldly-wise investors.

Beyond the obvious overhyped nature of the U.S. GDP, what's interesting about this latest estimate (3rd revision), is that it shows the PCE Index - which is, as has been mentioned ad nauseum over the past few years - the Fed's favorite inflation reading, ramping up to 3.7%. If the Fed's target for inflation is two percent and their BFF indicator is at 3.7% it doesn't take a genius to figure out that they haven't beaten inflation, as they claim they have. It also explains why stocks have been soaring. Precisely because inflation continues to ravage consumers, Wall Street sees this trend as extremely positive toward the Fed cutting interest rates, possibly as soon as their July FOMC meeting in another five weeks (July 29-30). By then, the S&P might be approaching 7,000 and the Dow over 45,000.

But, that's not all. The BEA also reported that consumer spending fell 0.1% in May, which stands to reason. People tend to spend less when prices are too high.

But, that's enough about the fake U.S. economy. Taking a look at the recent stock market upswing, it's clear that Wall Street has joined hands with Washington and the mainstream media in claiming victory over Iran with the bombing runs this past Saturday. Stocks have roared over the following days, with the S&P making a new all-time high on Thursday, which is not only fake, but also something else, that we're not allowed to speak of in the politically correct matrix in which we reside.

So far this week, stocks are banging up hard. The Dow is up 1180 points through Thursday's close. NASDAQ has tacked on some 720 points and appears to be not done yet. The S&P is up 173 points the past four sessions, so, apparently, the world is safe for democracy once again and Trump's tariffs don't matter now that our spectacular military has utterly demolished Iran's ability to enrich uranium to weapons-grade levels, which is all well and good, except that it's not true.

As the world lurches into the last weekend before the fourth of July, stock futures are once again registering to the upside, while gold is down another $64 this morning, to $3,283. Silver is also lower, at $36.15, which is, relatively speaking, not all that underpriced.

Gold peaked at $3,407 on Monday, so it's down just $124, which, after the gains made the past two years, isn't really much.

But, who needs pet rocks when you've got the Fed, the media, the military, the President, and congress all singing from the same hymn book?

At the Close, Thursday, June 26, 2025:

Dow: 43,386.84, +404.41 (+0.94%)

NASDAQ: 20,167.91, +194.36, (+0.97%)

S&P 500: 6,141.02, +48.86 (+0.80%)

NYSE Composite: 20,256.20, +168.75 (+0.84%)

No comments:

Post a Comment